In a physical store nowadays there payment service is standard for purchased items or services; payments by cash or card. However, online shopping offers more flexibility and convenience in payments, which is partially the reason for its popularity. Around 24% of consumers point out simple checkout as the main reason to shop online.

But to make the checkout service easy for your customers, you should place the effort into integrating and choosing the correct payment gateway for your business. If you manage this process correctly, you can attract more customers, improve customer retention, and upscale your business’ profitability.

In this article, we will focus on different payment gateways in various types of marketplaces, with real-life examples and trends.

How to Choose a Payment Gateway

You should not immediately choose the most popular and global aggregator for payments. Even the best settlement for marketplaces may not fit your product.

To choose a fee marketplace payments gateway, you will need to answer the following questions:

- Are the gateways supported in your region?

- How long is the provider on the market? The longer the provider’s history, the more experienced and reliable it is;

- Do the tariffs meet your and your customer’s requirements?

Let’s review these factors one by one.

1. Is the Marketplace Payment Gateway Supported in Your Region?

We would recommend starting your research with this question.

Popular global platforms like PayPal, Stripe, and Braintree are supported in most regions global. Among these regions are the USA, Asia, Europe, and Australia.

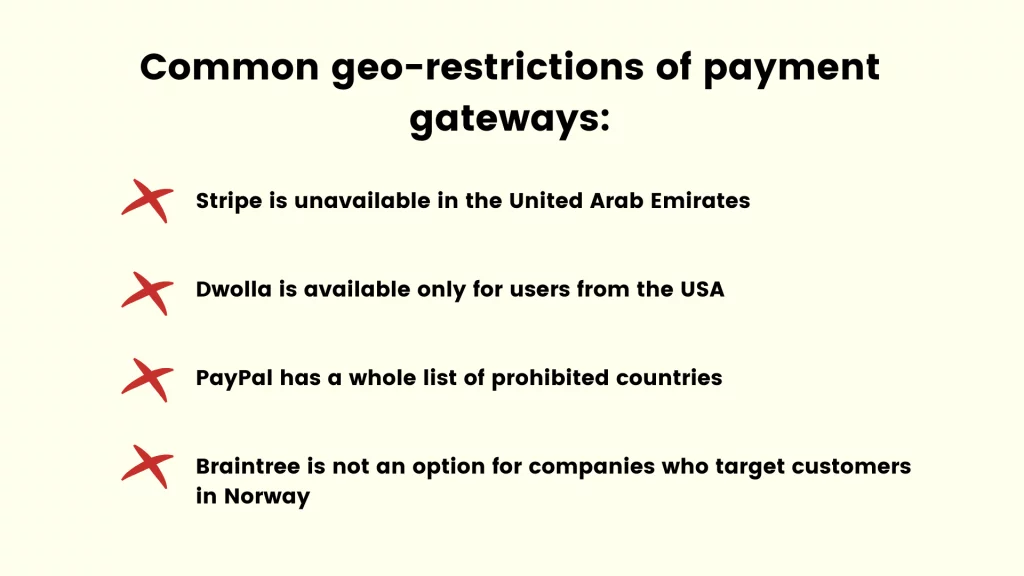

But still, some of the pay gateways have geo-restrictions. This is my advice to check whether your settlement solution is geo-friendly to your region. And to the region of your potential customers.

Here are some examples of geo-restrictions of pay gateways:

- Stripe is unavailable in the United Arab Emirates marketplaces

- Dwolla is available only for users from the USA

- PayPal has a whole list of prohibited countries. The list includes Belarus, Burma, Iran, Iraq, Liberia, Nigeria, North Korea, Sudan, Syria, Western Balkans, and Zimbabwe

- Braintree is not an option for companies who target customers in Norway

There are several geos where gateways appear to be unavailable.

For our clients from such regions, our service is find the most suitable local remittance company. For the employment platform Safhyre we chose to integrate PayFort. An Arabian local pay gateway was helpful here.

Dream of building a marketplace project?

2. How Long Is the Provider Is on the Market?

This is always a rule whether you are choosing a payment service provider. Or working with any other option for your business processing.

If a paying marketplace software provides customers with support for years, it has a stable reputation. Besides, it is likely to have a bunch of proven tools. Therefore, your payments will be safe, convenient, and easy for the marketplaces.

What are we considering for a long time on the market? Five to ten years will be enough. Among the most stable getaways for online marketplaces are platforms: Stripe and Braintree.

More on: The core difference between Stripe and Braintree

- Both were born over 10 years ago. Stripe was here in 2009 and Braintree – in 2007;

- They picked their niche by working with different types of internet businesses. Both work with companies and startups;

- Both have worked with great companies to prove their reliability.

3. Does It Support the Needed Payment Methods?

The majority of companies and businesses support the most common payments methods. The most popular are Visa, MasterCard, Discover, and Diners Club. Also, they are allowing you to integrate Apple Pay or Android Pay.

But sometimes you may require more exquisite software. Unique or local payments service to make your business processing more convenient for customers.

Common Payment Methods

The most popular ones various types of a credit card like Visa, MasterCard, JBC, Diner’s Club, AMEX, Discover. Apple Pay and Android Pay are also in. The majority of remittance providers support these fee account methods.

Other Methods

Time passes, and new methods appear all the time. One of the newest is the Alipay platform founded by the Alibaba group on 2% of the websites global, though the number is growing.

However, not all gateways can process payments through Alipay.

Stripe and Adyen allow the Alipay method integration, while PayPal, Adyen, and Braintree do not.

Venmo – a mobile service, that can be used only with Braintree.

Local Methods

Another provider, MANGOPAY allows not only using common payments methods. Among them are Visa, MasterCard, and Diner’s Club. But it is possible to use local cards from various countries. If you are starting a business in one of these locations, consider MANGOPAY a solution.

How to Integrate a Marketplace Payment Gateway

There are two main ways to implement a gateway to your marketplace payments. Choose between widget or via API:

Widget

You only need to integrate a provider’s widget into your marketplace, and storage and security will be up to your provider. One of the best widget examples is Stripe, allowing you to accept new payments and create subscriptions. However, as a disadvantage, such a widget may have an inappropriate or hard-to-adapt design.

API

You can integrate the discharge gateway via API, creating front-end part and page making. But, you have to be responsible for the money of customers. As far as you should store it before sending it to the vendor. You will need to pass the PCI DSS certification. Moreover, up to one year is needed to develop secure architecture and data storage.

The Expertise of Sloboda Studio

We’ve been focusing on online marketplaces for 7 years now. Our team tried out all the abovementioned payments tools and getaways.

Below we mention some of the most typical cases of integration payments.

Veeqo

Veeqo is a UK omnichannel retail platform for order management.

Being a big logistic platform, Veeqo used to process payments manually. All the invoices used to be arranged via bank transfers, or via phone. This manual system required a lot of time and resources.

Our Solution:

To digitize payments on the Veeqo platform. We decided to integrate Stripe, as it allows the use of different payment methods. Plus it is convenient for both the Veeqo team and Veeqo customer audience.

Need to integrate payment?

This marketplace is a cleaning online marketplace. It connects customers with professional cleaners in their local area. The customers can book cleaning accounts for their apartments.

The customer’s business model involves that fee takes place after the offline cleaning is completed. Therefore, issues with conducting the payments used to occur.

Our Solution:

First, we set up notifications about failures in payments.

Once a fee fails, it triggers an email notification about the unpaid cleaning. This notification invites the customer to log into the dashboard and pay for the service.

In the dashboard, the customer can see the reason for the remittance error. Here we also used the Stripe system to define the types of settlement errors.

SAFHYRE

SAFHYRE is a UAE online platform for recruiting that connects employers with employees.

The top providers do not work in the United Arab Emirates. There was a challenge. To find the system that would be supported in the UAE. And then, integrate it onto the platform.

Our solution:

PayFort is a friendly settlement system that is used in the UAE. However, there are a lot of restrictions. The banking system is imposed by the OAE. That is why building a subscription system demands numerous PayFort approvals.

Plus, Payfort has some API peculiarities. Lack of proper documentation. Requests had to be processed both on the front-end and back-end. The URL feedback led to different places.

We had to manually calculate the signature of the request. There were also typing errors in the Payfort API.

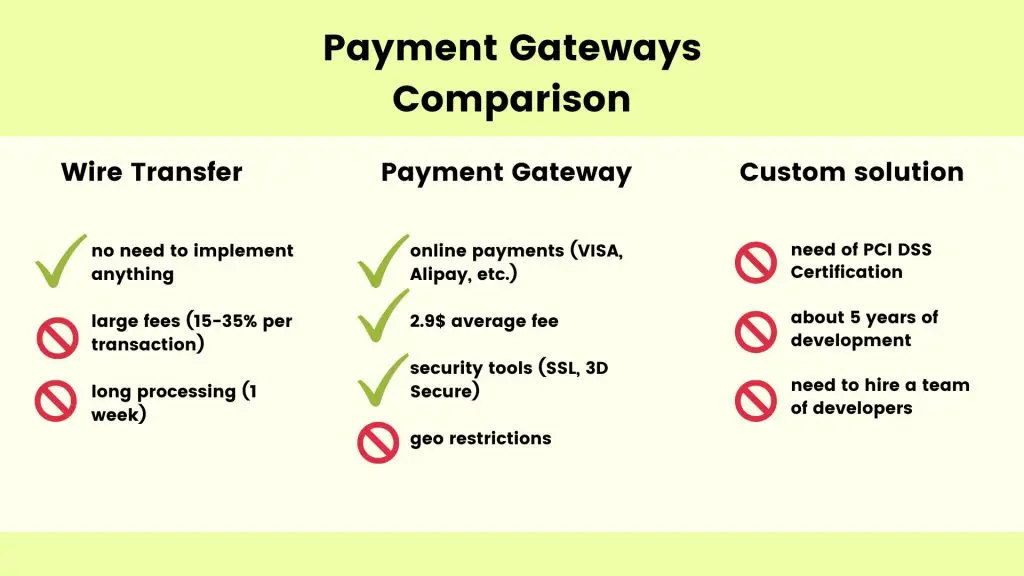

3 Payment Gateway Methods

Basically, when you are building an online marketplace, you have three main online marketplace payment solutions to choose from: wire transfer, payment gateways, and personal priorities for payments.

#1 Wire Transfer

This method allows you to accept money via direct bank transfer.

Lots of marketplace startups start monetization by using wire transfers. Then, they move to the use of some gateway. This is a reasonable choice of marketplace discharge service for very young projects.

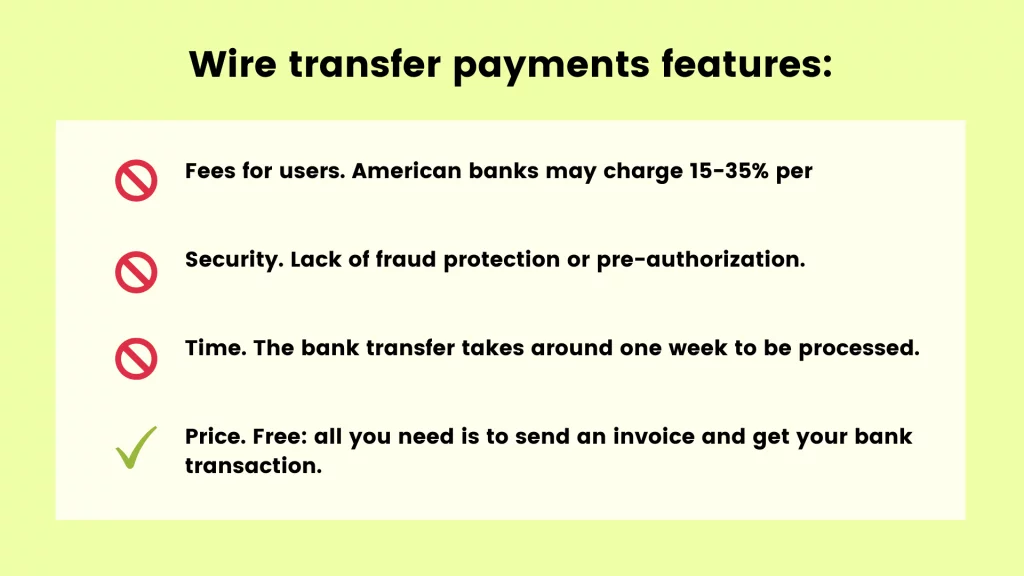

Peculiarities of wire transfer payments:

- Fees for users. There are large fees for bank or card transfers. American banks may charge 15-35% per transfer (TD Bank, US Bank, Citibank, etc.). Though European banks are cheaper for different payments. For instance, ING Bank (Holland) charges €6 per transfer.

- Security. Lack of features such as fraud protection or the ability to pre-authorize card or other payments. It is impossible to get reversals or chargebacks.

- Time. The bank or card transfer takes around one week to be processed. It is not convenient, especially when you have an Airbnb-like marketplace. If the online fee option is inappropriate, the fee delays. In this case, the client won’t be able to use the rent.

- Price. A good idea in case you are looking for a cheap option. All you need is to send an invoice and get your company bank transaction.

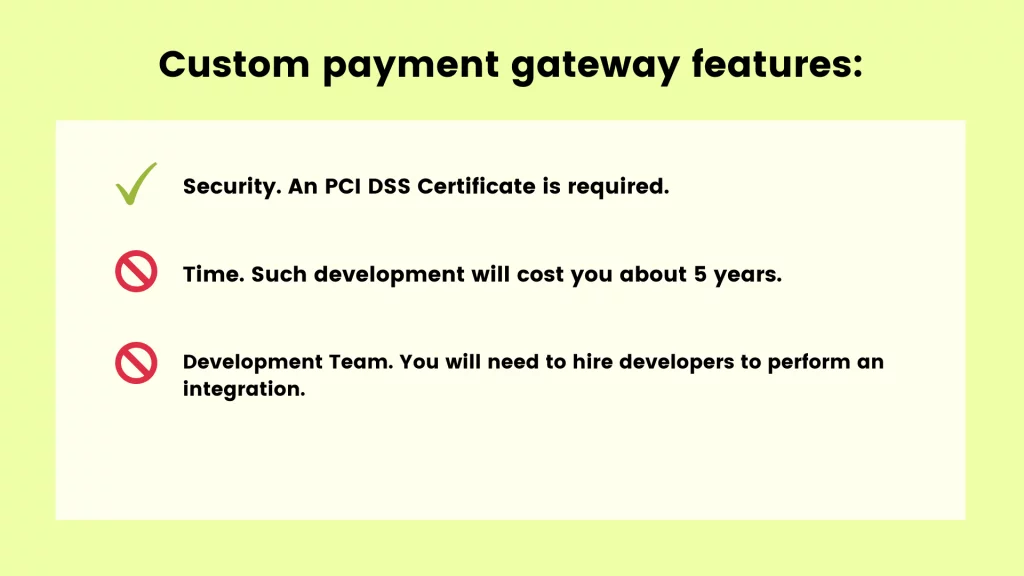

#2 Creating a Custom Payment Solution

Whatever product you imagine, can be created for custom card payments. Custom development service is suitable for any innovative marketplace. But it’s like re-inventing the wheel in most of the projects.

Cons of developing a custom remittance platform:

- Security and costs. To use your own pay integration, you will need to have a PCI DSS Certificate. Such a certificate will be required in every country when you are working.

- Time. Such development service will cost you about 5 years.

- Development Team. You will need to hire a team to integrate such online payment software. As a result, the whole thing will cost you too much time and money.

#3 Marketplace Payment Gateway

A marketplace remittance gateway is any paying software. Such software facilitates the procession of transactions between your marketplaces and your customers. We can say that there are a lot of different online fee options. But you need to make your choice considering such factors:

Today’s market offers a lot of different online remittance gateways. These gateways offer more or less unique features. However, using a remittance gateway remains to be the most reasonable option for online marketplaces.

Pros of remittance gateways for online marketplaces:

- Financial services.

Online remittance gateway options allow connecting different types of payments. Stripe and Adyen allow paying with an international credit card gateway and other methods. Among them are VISA, MasterCard, American Express, Alipay, etc.

- Fees for users

The average fee for one transaction is 2,9% + $0,30. PayPal for marketplaces in the US, Google Checkout, Amazon Payments, Braintree, and Stripe Connect marketplace payments.

- Ease of integration

A lot of remittance gateways are targeted at startups. Therefore, their documentation is clear (Adyen) and integration is quick (Stripe Connect). In some cases, the remittance gateways have a small API (MANGOPAY). Or are a bit more difficult to implement (PayPal).

- Security

The best remission gateways for the marketplace offer you various security tools. Among these tools are SSL, PCI, 3D Secure, and escrow payments. You can use tokenization and anti-fraud tools.

- Technical support

As usual, support is 24/7 (Stripe Connect). Some companies offer feedback forms, and support via phone in English, German, and French (MANGOPAY). Or offer you live chat (Dwolla).

- Geolocation

Before learning about how to implement a remittance gateway, check the geography of your provider. This is where you should be careful. As long as some online marketplace payment solutions are restricted in different countries. PayPal is partially restricted in some countries. Adyen doesn’t work in Ukraine and Stripe Connect is unavailable in the United Arab Emirates. As a vendor, you can only change a settlement provider. Or choose another country to register your marketplace.

What is Merchant Onboarding and How It Works

For small- or medium-sized businesses, integrating a payment service also means going through the merchant onboarding process. It can be steep or quick, depending on the provider you work with and how familiar you are with all the steps. However, despite all this, the onboarding process will most likely have a huge impact on payouts, sales, revenue, and even legal compliance.

Due to the risk of fraud, banks and payment service providers (PSPs) are legally obligated to implement a secure onboarding process that goes beyond simple yes-or-no questions. This includes Know Your Customer (KYC) checks to verify your identity and business ownership through documents and databases. Companies like MANGOPAY, a PSP, offer solutions to streamline these checks for merchants.

Let’s get into more detail regarding the steps you as a merchant would most likely undergo during the onboarding process.

- Prescreening: at this step, you can expect that the payment gateway provider will assess your business model and risk profile. This will ensure that the compliance regulations are met.

- KYC Checks: now, the payment service provider will use the KYC check to verify your identity and ownership through documents and government databases. Again, as in the previous step, this one contributes to compliance with regulatory requirements.

- Account setup: the payment gateway solution in some cases might help you set up the account. Overall, it will set the foundation for smooth payouts and efficient sales transactions.

- Store Information: then the payment gateway provider will tune in with the shipping policies and return procedures. It will help automate processes and improve sales.

- Financial Details: finally, at this step, the bank account information for receiving payouts will be collected. This enables secure and seamless payouts.

- Review and Approval: at this step, the provider will review the gathered information and approve or reject the application. Again, it helps to ensure compliance and sales potential.

- Training: once approved, it is possible that the software development company that helped you integrate, also will help with figuring out the new tool, leading to higher sales and ultimately, marketplace revenue.

Essentially, following these steps translates to faster access to payouts, streamlined sales transactions, improved compliance, and overall higher revenue. It will protect you and your customers, enabling you to achieve higher revenue with new payouts and deals made.

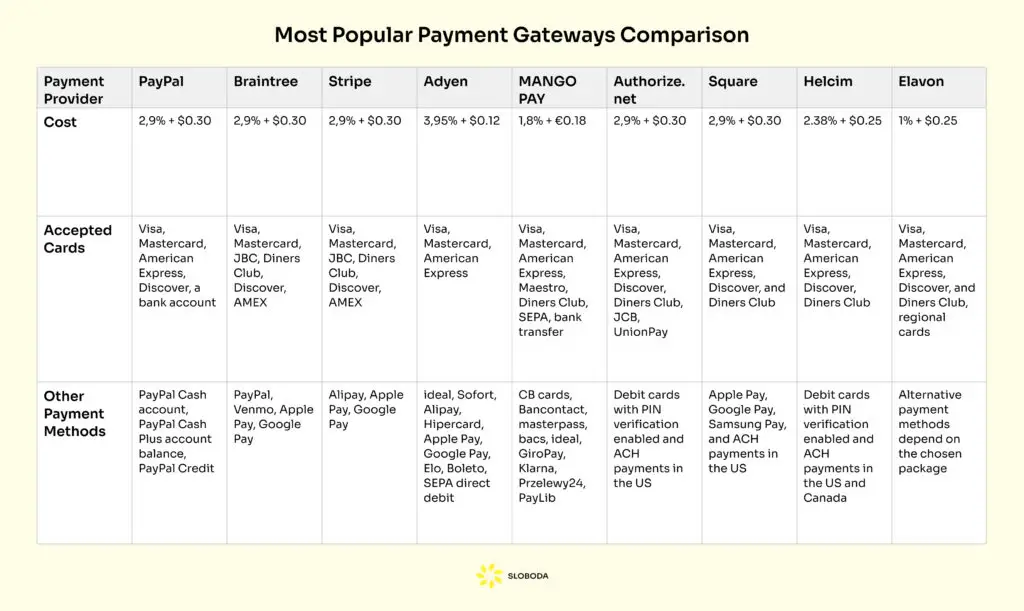

Most Popular Marketplace Payment Gateways in 2024

Let’s face it. Payment gateways appear to be the most effective solution for most businesses.

Most Popular Marketplace Payment Gateways Comparison

Regardless of the company size, fee gateways are good both for small businesses and enterprises. The market-leading fee gateways are PayPal, Braintree, Stripe Connect, MANGOPAY, Adyen, and Dwolla. All of them have their own unique account features, so let’s take a look at them.

PayPal

PayPal is one of the most extensive debit electronic American marketplace payments. The company enables customers to digitally pay for goods and services and has made significant gains in mobile settlement volume.

In the fourth quarter of 2023, PayPal’s net payment volume amounted to around $409.83 billion, representing nearly 15% year-on-year growth.

PayPal for your business

Stripe (or Stripe Connect)

The Stripe discharge gateway company is an American online payments processing software provider. It suits different types of Internet businesses. Stripe positions itself as a marketplace service both for startups and large companies.

Check out: Why most online businesses choose a Stripe getaway

Stripe Connect for platforms and marketplaces

MANGOPAY

It’s an online discharge company designed for marketplaces, crowdfunding platforms, and sharing economy business payments.

MANGOPAY for your company

Braintree

As well as Stripe, Braintree Pay Gateway provides economic software for online merchandising platforms. Especially it is great for e-commerce platforms. Born in 2007, Braintree was acquired by another giant pay gateway, PayPal in 2013.

Recommended: Comparison of Braintree vs Stripe

Braintree solution for your company

Adyen

Adyen issues physical and virtual cards. It also provides businesses with in-store account terminals.

Adyen for your company

Global and trusted brand, Authorize offers a variety of features, including fraud prevention, recurring billing, and mobile payments. The system integrates with a wide range of shopping carts and platforms.

Authorize.net for your company

Square

Square is easy to set up and use, even for non-technical businesses. It offers a variety of point-of-sale hardware and software solutions, as well as stays popular with competitive pricing.

Square for your company

Helcim

If you have a high-volume business, the pricing of this marketplace payment gateway will most likely seem enticing. They also offer excellent customer support and a variety of features, including fraud prevention, recurring billing, and international payments.

Helcim for your company

Elavon

This payment gateway offers a wide range of payment processing solutions, including merchant accounts, credit card terminals, and online payment gateways.

Its strong reputation for reliability and security makes it popular among bigger businesses.

Elavon for your company

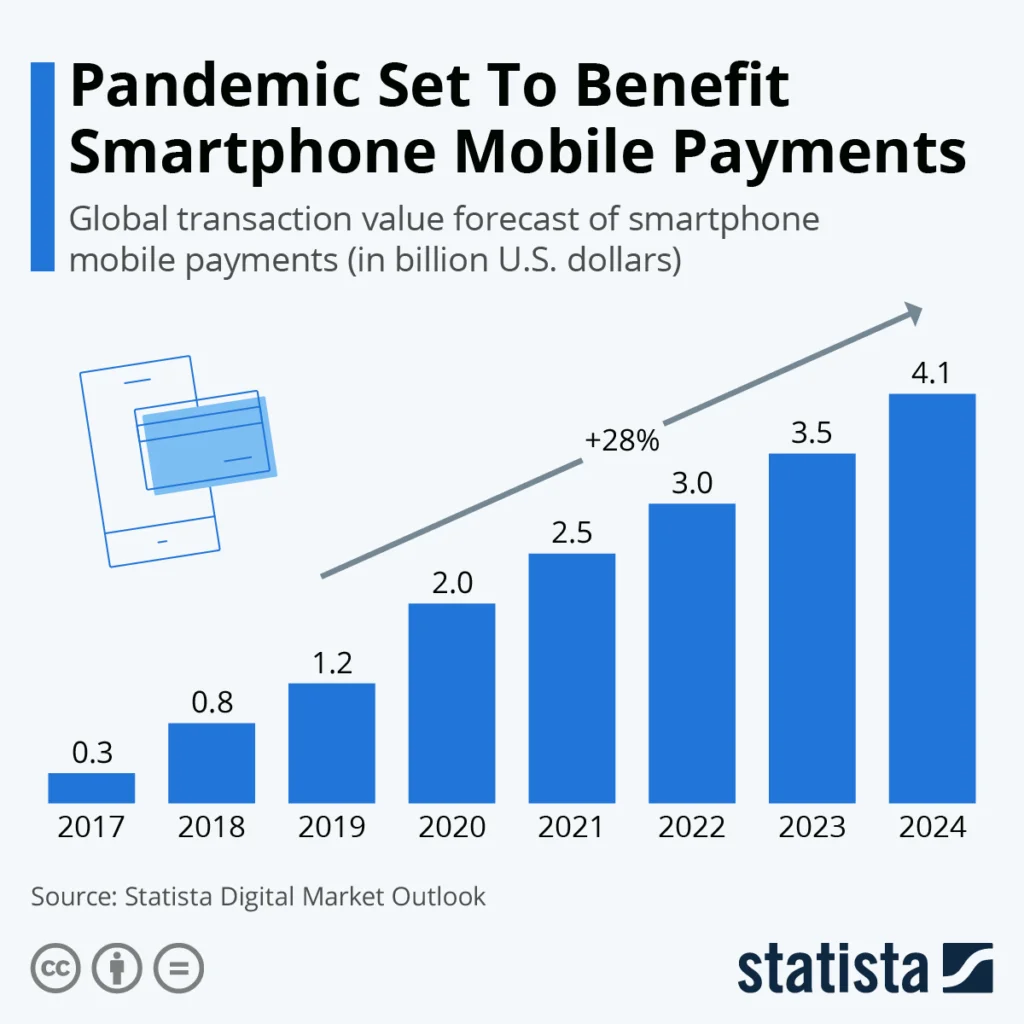

Marketplace Payment Trends for 2024 and Beyond

The experts expect digital marketplace payments will reach $11.55 trillion in total transaction value in 2024.

The projected CAGR for 2024 to 2028 is 9.52% which would lead to a total amount of $16.62 trillion by the year 2028. The largest market in 2024 is Digital Commerce, with a projected total transaction value of $7.63 trillion in 2024.

Furthermore, the total transaction value of Digital Payments is projected to reach the astonishing amount of $16.62 trillion by 2028.

Source: Statista

What Are the Most Popular Marketplace Payment Options

The most popular marketplace payment options include a credit/debit card, digital wallet (such as PayPal, Apple Pay, and Google Pay), bank transfer, and in some cases, cryptocurrency. These options provide convenience, security, and global acceptance, catering to diverse user preferences and facilitating seamless transactions on marketplaces.

Summary

It is not that difficult to choose a marketplace solution for payments. But consider which benefits your business platforms you will get with some particular fee service.

So how to choose a marketplace payment solutions? We offer you a quick checklist.

- Choose the type of pay in your marketplace. Three of them are bank transfers, remittance gateways, or custom payment systems. We concluded that payment gateways are the most convenient to work with. Especially when you need a perfect balance of features and prices.

- Make a list of remittance gateways. Braintree, Stripe, PayPal, Mangopay – you should know what to choose from.

- Consider different marketplace pay methods. There should be all the standard types of a credit card and e-wallet. If you need to work with local payment methods, check its availability as well.

- Check the fees. As usual, most remittance gateways take a 2,9% fee per transaction. However, some providers can request a percentage of a transaction amount, so be careful.

- Check geolocation. Some payment gateways can be restricted in different regions. Check whether the chosen solution is available in your country.

Frequently Asked Questions

What are the main benefits of marketplace payment solutions?

There are some main benefits you should pay attention to:

-Fees for users

-Easy to integration

-Security

-Financial services

-Geolocation

-Technical support

What are the best marketplace payment solutions?

There are the 5 best marketplace pay methods:

1) Stripe

2) Paypal

3) Braintree

4) Mangopay

5) Adyen

What marketplace payment solution is best for your project?

We can confidently say that choosing the best marketplace payment platform depends on your business needs, the target audience, core features, and ease of integration.