Marketplace liquidity is immensely important for the marketplace’s life cycle. For a business owner, it is advisable to keep track of the time and process of acquiring and selling goods on the platform. This concept can majorly impact such success indicators as customer retention, profit generation, etc.

Overall, marketplace liquidity aims to make the market more efficient for both buyers and sellers sides. To achieve a high liquidity score, there are some factors and strategies that you can utilize. In this article, we will brush up on the most popular of them.

Marketplace Liquidity Definition

Marketplace liquidity refers to the ease with which assets or products can be bought or sold within a marketplace without causing a significant impact on their prices. This concept can be applied to various marketplaces, including e-commerce platforms, online marketplaces, and physical marketplaces.

To put it simply, imagine a marketplace as a place where people buy and sell things. Now, think about how easy or difficult it is for people to quickly buy or sell items in that marketplace. That ease is what we call “marketplace liquidity”, the likelihood that someone will make a transaction in your marketplace.

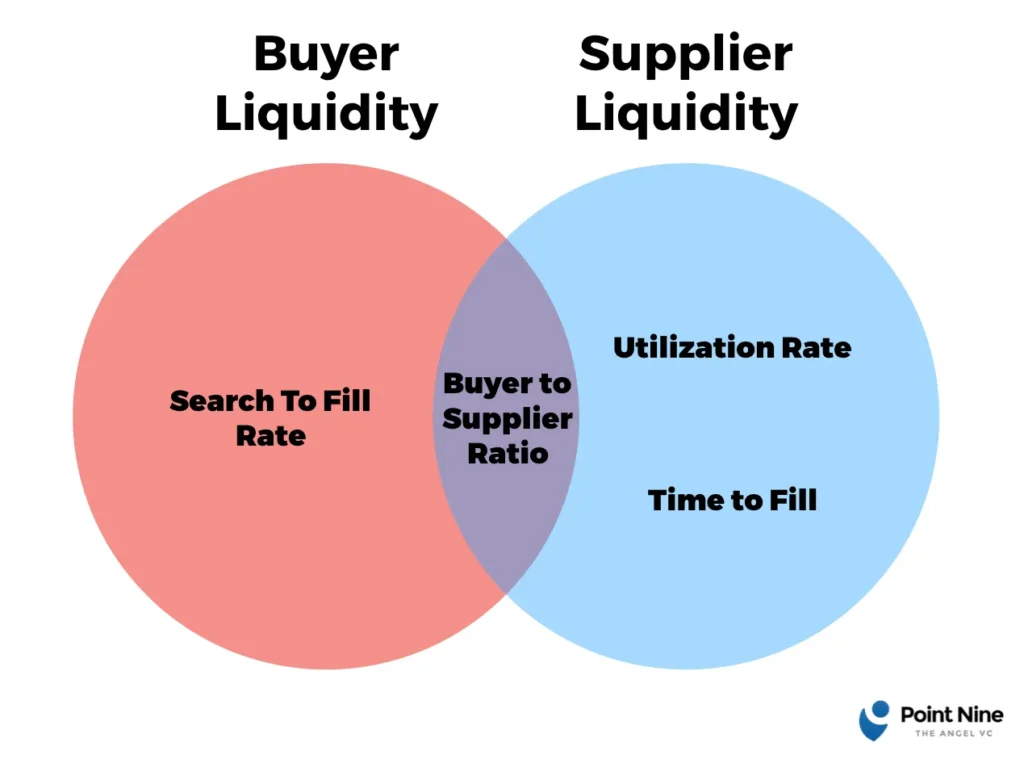

Generally, marketplace liquidity is divided into two other concepts: suppliers and buyers liquidity. Each of them reflects the efficiency of a certain user group:

- for buyers, it’s the number of visits turned into transactions

- for suppliers – the percentage of listings that lead to transactions.

Buyers’ and Suppliers’ Liquidity

Buyer liquidity can measure how easily potential buyers can find and acquire what they’re looking for.

A market with high buyer liquidity boasts a number of eager buyers actively seeking products, making it convenient for sellers to find interested parties and complete transactions swiftly.

Low buyer liquidity indicates a scarcity of willing purchasers, potentially resulting in a slower pace of transactions. Then, it becomes more challenging for a certain percentage of sellers to find buyers for their offerings.

Supplier liquidity assesses how easily suppliers can fulfill orders and maintain a steady flow of products to meet market demands.

A marketplace characterized by high supplier liquidity typically features a percentage of responsive and well-prepared suppliers who can adapt to changes in demand, ensuring a smooth and reliable supply chain.

The opposing low liquidity may lead to delays, shortages, or increased difficulty for buyers sourcing the desired products or services.

How Liquidity Affects Different Types of Marketplaces

From both sides, buyer and supplier, liquidity plays a critical role in shaping the dynamics of B2B (business-to-business), B2C (business-to-consumer), and P2P (peer-to-peer) marketplaces. The interaction between these two factors influences the marketplace’ overall health and efficiency. Looking at this, a business owner can quickly assess their marketplace’s position.

In B2B transactions, buyer liquidity is vital for businesses seeking to acquire goods or services to meet their operational needs. High buyer liquidity ensures a number of businesses actively seeking supplies, facilitating smoother transactions and fostering a competitive marketplace.

For B2C businesses, however, supplier liquidity is essential to meet consumer demands and avoid stockouts. Suppliers must be capable of adapting to fluctuations in consumer demand, especially in fast-moving industries where trends and preferences change rapidly.

And, finally, in peer-to-peer interactions, buyer liquidity is reflected in the readiness of individuals to engage in transactions. In platforms where a number of users buys and sells directly to each other, both types act as buyers and suppliers simultaneously. High buyer liquidity ensures a vibrant marketplace with ample opportunities for transactions between peers.

5 Factors Affecting Marketplace Liquidity

Marketplace liquidity is a volatile concept influenced by many factors. Among them are imbalances, costs, time given, and even marketplace models. In this paragraph, we will focus in more detail on what can change marketplace liquidity and how.

Supply and Demand Imbalances

Liquidity is tied to the balance between supply and demand.

With too few buyers, sellers may struggle to find transactions, leading to decreased liquidity in a short time given.

Similarly, if there are too few sellers, buyers may face challenges finding the products or services they seek. This imbalance is often referred to as the “Chicken and Egg” scenario, where the presence of one side (buyers or sellers) is contingent on the other.

For example, imagine a company that sells flowers. They become very popular during holidays such as St. Valentine’s Day, which leads to the company’s rising prices. The raised prices overstep the competitive fringe accessible for most buyers, hence the liquidity drops as buyers become less interested in the goods sold.

Imagine the opposite situation, where the flowers are affordable however the seller only provides buyers with camomiles and tulips. The demand grows for roses and other types of flowers, the percentage of buyers is higher than the goods offered, and the liquidity drops yet again.

Need to Balance Your Marketplace?

One of the most popular and effective ways to solve this problem is the diversification strategy. Make sure that you keep the demand in focus, reduce the dependence on one singular item (one type of flowers in this case), and position yourself for scalability (e.g. prices might be too steep for the countryside, but won’t be as hefty for people from the city, hence delivery might be a great option).

Transaction Costs

Transaction costs, including fees, commissions, and other overheads, can significantly impact liquidity. High transaction costs may deter market participants, reducing the frequency of trades and overall liquidity. On the other hand, lower transaction costs can attract more participants, fostering a more liquid marketplace.

Traders and investors often consider transaction costs when deciding to enter or exit the market, influencing liquidity dynamics.

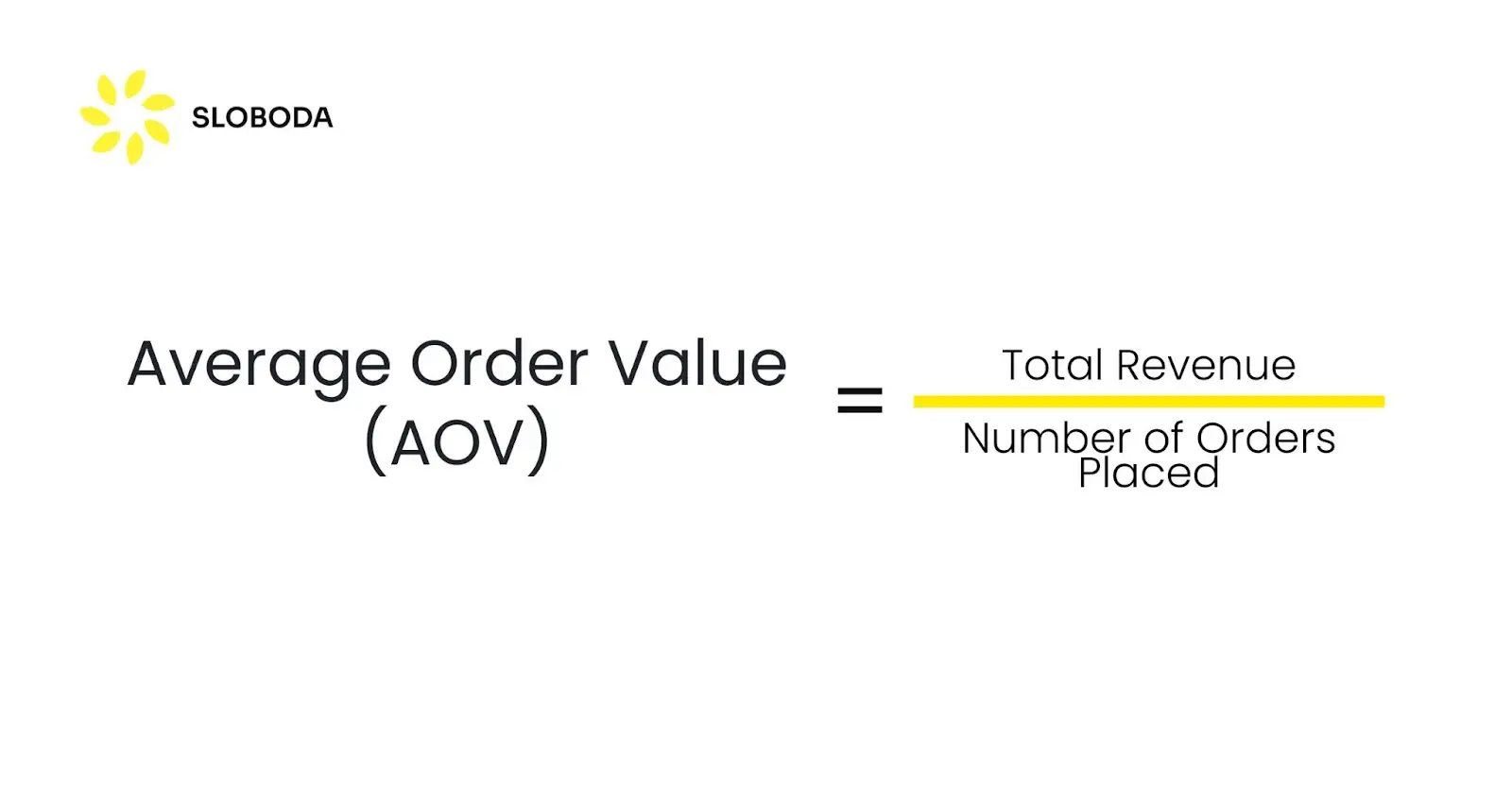

Marketplace KPIs can be of great assistance in the case when you need to monitor whether the costs are competitive and if they are hindering your business during a certain time. So, you could start with calculating gross merchandise value (GMV), and continue by analyzing average order value (AOV). GMV would allow you to see the general economic activity of your marketplace platform.

AOV would lead to an understanding of your average customer’s financial capabilities.

Different Marketplace Models

In a buyer-picks model, buyer has more influence, and seller competes for their attention. Liquidity in this model is highly dependent on a consistent influx of buyers actively seeking a certain product or service. If buyer interest wanes, it can lead to a decline in liquidity as the seller struggle to find transactions.

Marketplace-picks model allows the product or marketplace to determine which products or services are highlighted or promoted. Liquidity here is influenced by the marketplace’s ability to drive attention and transactions. The platform’s marketing strategies, user engagement, and curation directly impact liquidity.

Types of Marketplaces

Source

The double-commit or the hybrid model combines elements of both buyer-picks and marketplace-picks. With this model, liquidity is influenced by the interplay between buyer demand and the platform’s role in showcasing or recommending items. The success of a double-picks marketplace relies on effectively balancing the needs and preferences of both buyers and the marketplace.

Trust and Reputation

The confidence buyers have in the reliability of sellers, and vice versa contributes to a smooth flow of transactions.

Positive reviews, ratings, and a transparent feedback system build trust, encouraging more participants to engage in transactions. In contrast, a lack of trust or concerns about the reputation of participants can hinder liquidity, as buyers and sellers may be reluctant to interact.

Technology and Infrastructure

The role of technology and infrastructure cannot be overstated in facilitating marketplace liquidity. Efficient platforms with user-friendly interfaces streamline the buying and selling process, making it easier for participants to navigate and complete transactions.

Fast and secure payment systems, robust order processing, and responsive customer support contribute to a positive user experience, fostering trust and confidence. Since over 18% of users find the checkout process too daunting, making it simpler will not only contribute to user experience but potentially induce customer retention.

Conversely, outdated technology or infrastructure bottlenecks can impede liquidity by creating friction in the transaction process and deterring market participants.

Quantifying Marketplace Liquidity: Metrics and Ratios

As markets evolve and transform, the need to assess and quantify liquidity becomes increasingly crucial for participants seeking efficiency, transparency, and strategic decision-making. So, let’s dissect the principles of how to focus and utilize liquidity.

Types of Liquidity in Marketplaces

Source

The Buyer-to-Supplier Ratio: Balancing the Scales of Transaction

The buyer-to-supplier ratio can measure the relationship between buyers and suppliers and explores the balance between the numbers of users from both categories.

A balanced buyer-to-supplier ratio signifies a healthy marketplace, where the number of buyers seeking goods or services harmonizes with the available suppliers. On the contrary, an uneven ratio may reveal challenges, such as an oversaturation of suppliers relative to the demand or scarcity.

Search to Fill, Time to Fill, and Utilization Rate: Other Metrics in Focus

Beyond the buyer-to-supplier ratio, more than one metric plays a crucial role in gauging and optimizing marketplace efficiency.

Search to fill metric can measure the speed at which buyers can find suitable product or service on the platform. This metric reflects the marketplace’s responsiveness.

Time to fill metric shows how much time it takes to complete transactions, offering insights into the efficiency of the supply chain and transaction processes. You can try to use a transaction management system. Some of them automatically track timestamps, which would help to collect and analyze data. Among them could be various payment gateways like Stripe or PayPal, or point-of-sale (POS) systems like Shopify POS or Square.

Additionally, the utilization rate metric unveils the extent to which available resources, such as suppliers or inventory, are actively engaged in transactions.

By focusing on these supplementary metrics, marketplace stakeholders can gain a comprehensive understanding of liquidity. These metrics might help implement strategic measures to improve the overall marketplace experience.

Strategies to Improve and Sustain Marketplace Liquidity

Strategies to improve and sustain liquidity are crucial for the financial stability of your marketplace. Two key approaches stand out, each contributing to the seamless flow of transactions and long-term marketplace growth.

Enhancing Matchmaking and Transaction through Technological Solutions

Embracing cutting-edge technological solutions is instrumental in elevating the matchmaking and transactional processes within a marketplace.

Implementing advanced algorithms, machine learning, and artificial intelligence can enhance the precision of matching buyers with suitable sellers, optimizing the overall efficiency of the marketplace.

Smart recommendation systems can tailor suggestions based on user preferences and historical behaviors, streamlining the search process and expediting transaction cycles.

Additionally, a user-friendly interface and seamless integration of secure payment gateways contribute to a positive user experience, fostering trust and confidence among participants.

Technological solutions not only elevate the speed and accuracy of transactions but also position the marketplace as a forward-thinking and adaptive product in the eyes of its users.

The most prominent examples of these marketplaces are Amazon and Upwork:

- Amazon utilizes recommendation engines, personalized search results, and targeted advertising to match buyers with relevant products.

- Upwork marketplace uses skills assessments, user reviews, and project matching algorithms to connect freelancers with suitable projects.

Leveraging Network Effects: A Cyclical Path to Sustained Marketplace Growth

Harnessing the power of network effects can set in motion a cyclical pattern of growth, propelling sustained marketplace liquidity.

As more participants join the platform, the value of the marketplace increases, attracting additional users and suppliers. This positive feedback loop creates a self-reinforcing cycle where a larger user base leads to more transactions, which in turn attracts even more participants.

To leverage network effects effectively, marketplace operators must focus on strategies that encourage user acquisition, engagement, and retention. Among the strategies could be the integration of augmented reality since it is known for boosting customer engagement, or shifting your focus to buyer-to-seller ratio, to increase balance on your platform. By capitalizing on network effects, marketplaces can build resilience and longevity, ensuring liquidity remains a constant driving force.

The biggest examples of this approach are Uber and Lift. They both connect passengers with drivers, directly benefiting both. More drivers lead to faster pick-up times, attracting more passengers, leading to more drivers joining the platform, and so on.

Real-World Applications and Case Studies of Marketplace Liquidity

Marketplace liquidity is applicable in a wide range of industries and sectors, as we’ve emphasized before. Here are some of them:

- E-commerce: Online marketplaces like Amazon, eBay, and Etsy rely on high liquidity to provide a diverse selection of products to buyers and attract a large pool of sellers.

- Freelance platforms: Number of marketplaces like Upwork, Fiverr, and Guru facilitate the exchange of a freelance service between regular users a.k.a. clients and providers. Here, liquidity can ensure a seamless flow.

- Ticketing platforms: Marketplaces like StubHub, TicketMaster, and SeatGeek connect event organizers with ticket buyers. In this case, liquidity can help in preventing scalping and providing a smooth buying experience.

- Crowdfunding platforms: A product like Kickstarter, Indiegogo, and GoFundMe relies on liquidity to attract investors and support creative projects. A thriving marketplace ensures that projects can reach their funding goals and successfully launch.

- Real estate marketplaces: An online product like Zillow, Trulia, and Redfin connects buyers and sellers of real estate. Liquidity might provide a wide range of listings, facilitating price discovery, and enabling efficient transactions.

Case Studies of Marketplace Liquidity

Several popular marketplaces were able to increase liquidity and achieved sustainable growth.

As an example, here are the most astounding cases:

- Etsy: A wonderful example, Etsy has established itself as a marketplace platform for handmade and vintage goods. They focus on unique and high-quality products, along with a strong community of sellers and buyers, has contributed to their high liquidity.

- Fiverr: Fiverr popularized the gig economy, connecting freelancers with clients for various services. This example is a streamlined marketplace, competitive pricing, and emphasis on buyer satisfaction have driven significant liquidity.

- Amazon: Amazon has become a dominant force in e-commerce, offering a vast array of products and services. Their global reach, efficient logistics network, and strong brand reputation have contributed to their unmatched liquidity.

- Upwork: Upwork can be an example as it is a leading marketplace platform for freelance work, connecting professionals with users across various industries. Their focused approach to freelance services, emphasis on skills and experience, and user-friendly product have made it a popular choice for both buyers and sellers.

- StubHub: StubHub is one of the largest ticketing marketplaces, providing a secondary market for event tickets. Their focus on providing authentic tickets, competitive pricing, and secure transactions has enabled them to improve liquidity.

Conclusion

This invisible force, the concept of liquidity, is a great way to shape the dynamics of your marketplace, fostering the development of buyers and sellers.

With integrations of various payment systems, advanced security, enhanced trust, and top technology, marketplace liquidity grows higher, upscaling the marketplaces along with it.

So, depending on what affects your marketplace the most you could determine the right way to work around marketplace liquidity. It will be different for every marketplace, depending on whether your app or website affected the most by supply and demand imbalance, transaction costs, or other factors.

In the end, two strategies posed in this article – enhanced matchmaking or networking – could help your business achieve the highest results.

All in all, marketplace liquidity can change the efficiency of your business, shape your workflow, and change the outlook your users have on the brand.

Frequently Asked Questions

What is marketplace liquidity?

Marketplace liquidity refers to the smoothness and efficiency with which buyers and sellers find each other and complete transactions on your platform. It reflects the health of your marketplace, as both buyer and seller satisfaction depends on it. Imagine a busy marketplace with satisfied users on both sides (high liquidity) compared to a deserted one with few participants (low liquidity).

How can I build and sustain marketplace liquidity on my website or app?

It’s a multi-step process:

- Attract both sides: Define your target audience, offer a compelling value proposition, and reduce entry barriers.

- Enhance user experience: Build trust, personalize the experience, enable efficient search, and streamline transactions.

- Nurture user engagement: Foster community, host promotions, provide excellent customer service and actively gather feedback.

What are the best ways to measure marketplace liquidity?

Different metrics assess different aspects:

- Overall volume: GMV, transaction count.

- Buyer-side liquidity: Search to fill rate, conversion rate, time to first order.

- Seller-side liquidity: Listing conversion rate, sell-through rate, time to sell.

Remember:

- Use a combination of metrics to get a holistic view.

- Benchmark your metrics and track progress.

- Analyze data to identify areas for improvement and implement targeted strategies.