Traditional banks are well known for their lengthy queues and neverending bureaucracy. Unlike these banks, online mobile banking allows customers to open new accounts, perform transactions, and do many other banking actions online, within seconds. This is why many business owners nowadays are starting to think about how to create a money transfer app.

The annual growth rate of the global mobile app payment market is expected to grow to $2983.9 billion by 2032. This is a huge increase compared to previous years. For example, this number in 2022 was approximately $942.3 billion. It brings us to the total CAGR of over 12%.

That’s why the development of online money transfer, or other banking apps like Revolut has gained momentum in the last few years. Launched in 2015, Revolut grew to 350,000 active daily users in only three years. This person-to-person platform is now valued at $33 billion.

So, based on the data, the money transfer app development can be very beneficial and profitable. In this article, we will show you how to build a successful money transfer app.

Step-by-Step Guide on Building Money Transfer App

Now, let’s talk about the steps required to build a money transfer app.

Step 1. Ideation

First before the development, you have to identify the pain points or challenges you want to solve for your potential audience. This would be a perfect moment for ideation. It is an initial stage that involves brainstorming, defining your target audience, and validating your concept through market research. Think of it as sketching your money transfer app’s blueprint.

Step 2. Analytics & Market Research

Before diving headfirst into development, it’s crucial to understand the competitive landscape. This is why market research is important. It is there to identify existing solutions, analyze their strengths and weaknesses, and assess potential gaps you can fill. Hence, using this data-driven approach might help you ensure your transfer app stands out among other apps after the development.

Step 3. App Platform Selection

You need to choose a platform to stick to during the development. Will you build a native fintech app for iOS or Android, or opt for a cross-platform solution? First of all, this decision will affect your budget and desired features. Each solution has its unique advantages and considerations, so carefully weigh your options. It’s better to start by focusing on one at a time. Also, some technologies can effectively preserve your budget, such as Flutter. However, there is a standard array of technologies mostly used for mobile development, timeless and efficient, and if you need any help with this, you can consult with us to ensure you made the right decision.

Step 4. UI/UX Design

This stage breathes life into your fintech app’s visual identity and functionality during the development. User interface (UI) design focuses on aesthetics and usability, while user experience (UX) design ensures smooth and intuitive interactions. Think of it as a process of development of a beautiful and user-friendly interface that guides users seamlessly through your app’s journey.

Step 5. App Development

And this is the most important part of the development process, and the most lengthy one. Developers translate your designs and functionalities into code, building your transfer app’s core. It basically encapsulates the development as a whole. Depending on the complexity, this stage may involve front-end (user-facing) and back-end (data and logic) development.

Step 6. Testing

Rigorous testing is a crucial development stage before unleashing your app on the world. Testers identify and fix bugs, assess performance, and ensure a smooth experience across different devices and platforms.

Step 7. Deployment to an App Store

Submit your fintech app to the relevant app store (e.g., Apple App Store or Google Play Store) after the development completion, adhering to their guidelines and providing detailed descriptions and screenshots. After approval, your app is ready to be downloaded and enjoyed by the world!

The mobile app development journey is an exciting adventure, filled with challenges and rewards. But this is just the beginning – continuous updates, user feedback, and adaptation are crucial for sustained success in the ever-evolving world of mobile transfer apps.

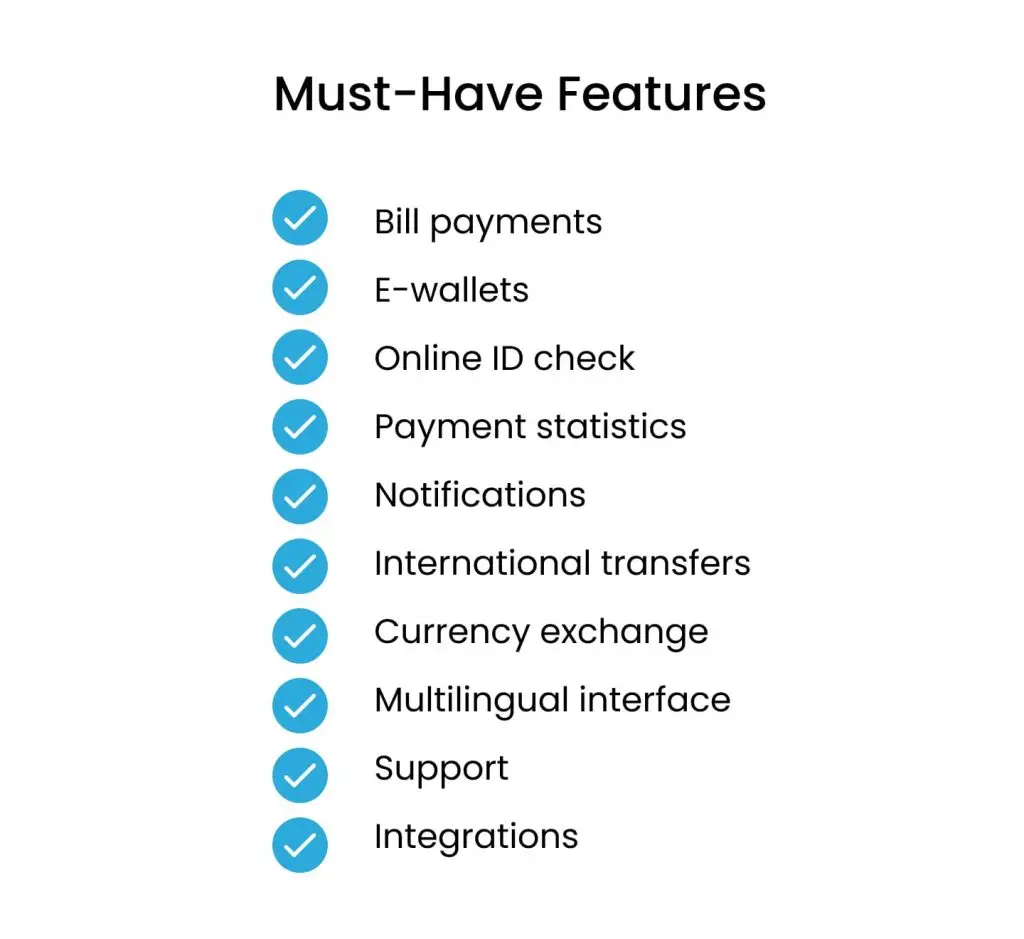

10 Must-Have Features Of a Money Transfer App

Before companies learn the intricacies of a money transfer app development process like Revolut, it’s crucial to define the core features.

Bill payments

This feature is needed for financial software to provide your future customers with the ability to pay bills at any time and from any place online. Paying bills is always seen as a burden. This feature will help give your product an additional competitive advantage and attract new customers.

Splitting and paying bills with Revolut

E-wallets

E-wallets can be online mobile service or apps that allows users to make electronic transactions, but different from a bank.

When integrating such a wallet, users can interact with the service and pay contactless in every country they visit without having to create multiple bank accounts each time.

Revolut cryptocurrency wallet

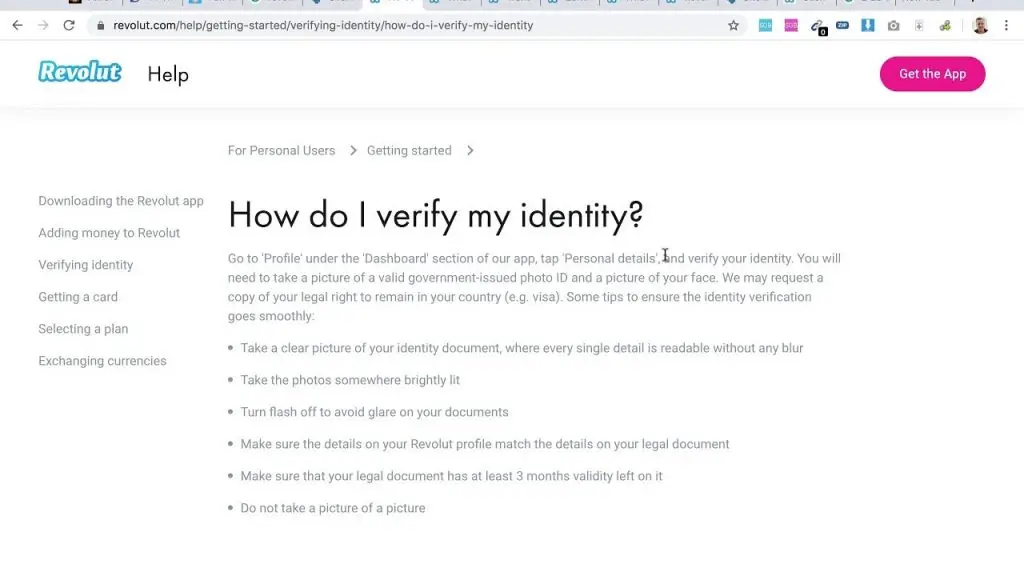

Online ID check

Online ID verification is a process that helps to check whether your transfer app interacts with a real person. An online ID check also ensures that your users are who they claim to be. Such a process prevents your financial software and your customers from any kind of fraud.

Adding an online ID check as an account confirmation stage helps you make your own peer-to-peer payment system safer for your customers. It is helping them to feel more protected. We recommend integrating automated verification requests and setting money limits.

Revolut ID Verification

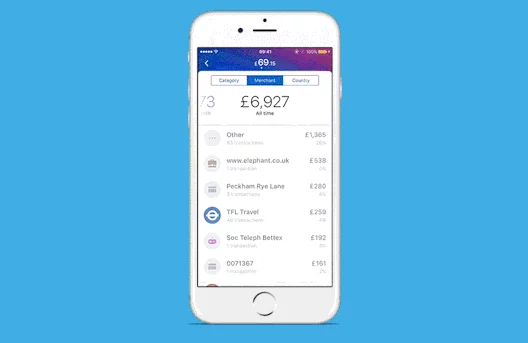

Payment Statistics

A payment statistics system is a set of features that helps to visualize all the user’s transactions by such criteria as volume, status, receiver, or even country.

These features are especially good for those users who like managing their finances. Therefore, your mobile platform will be more convenient and user-friendly, attracting new customers, and making their experience smooth.

Revolut payment statistics

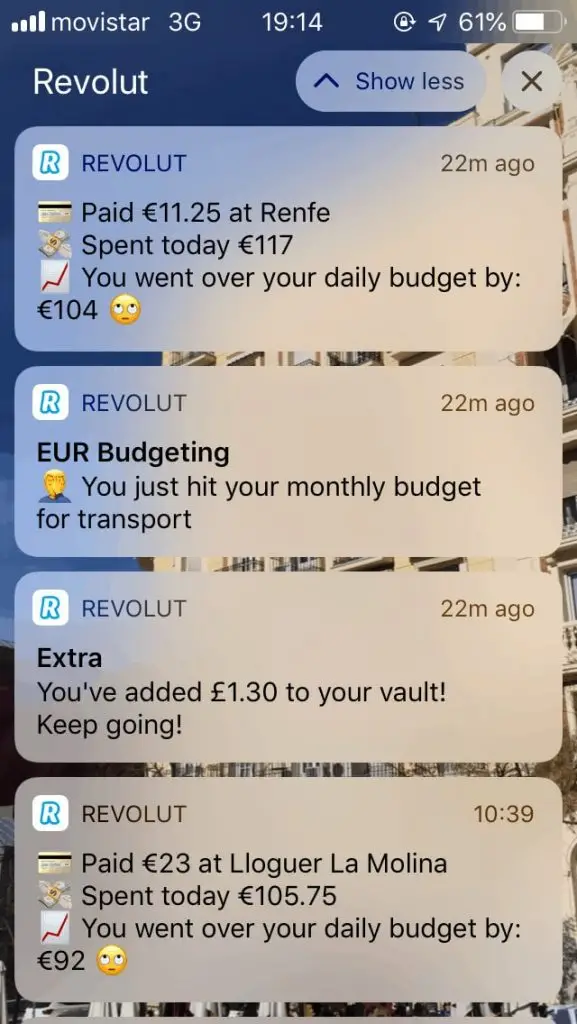

Notifications and Alerts

Any notification is important. It allows financial software to inform customers about all the actions within their banking accounts. For instance, you inform people about the status of their transactions, payments, or monthly subscriptions.

Revolut notifications

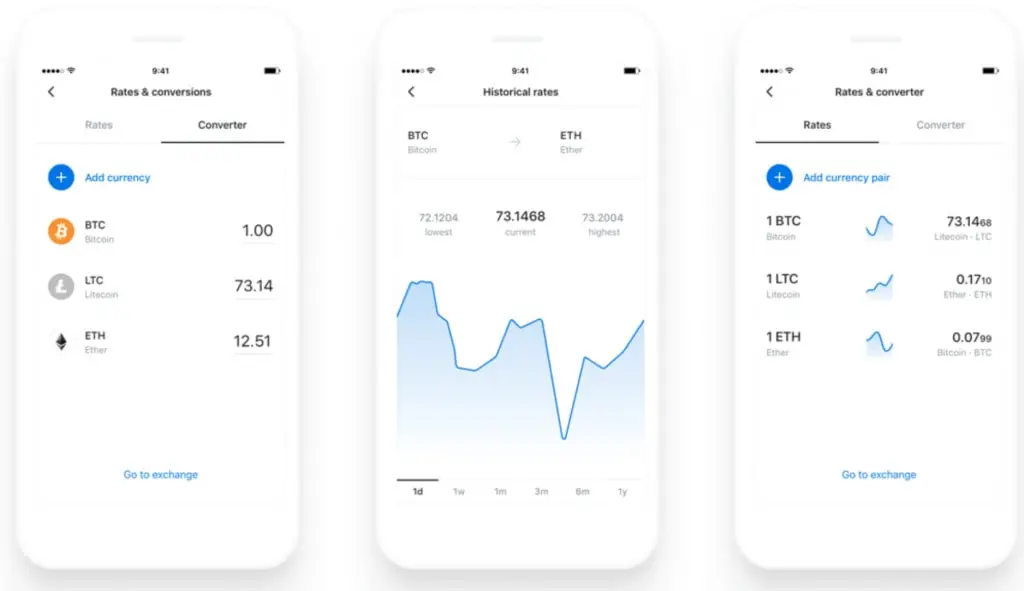

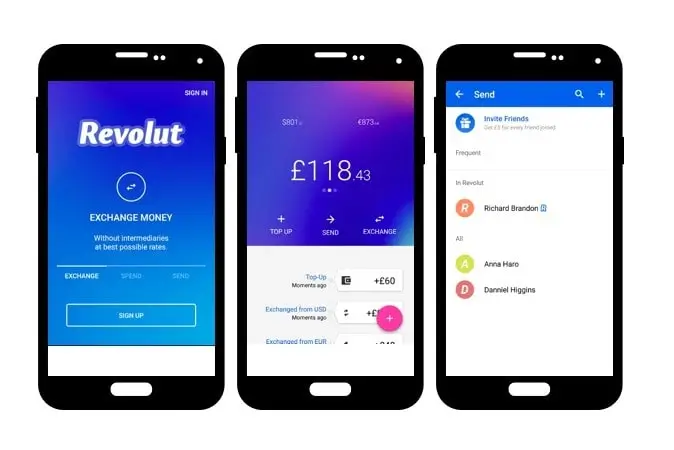

International Transfers and Currency Exchange

Traditional money transfers can be long, delayed, or require exorbitant fees.

Moreover, though international transfers aren’t new for modern banking, in a traditional bank it would often be a demand that users visit a physical branch to conduct a transfer. Integrating online transfers and exchanges to a banking mobile app account would enable users to send and receive their money within a few seconds and swipes.

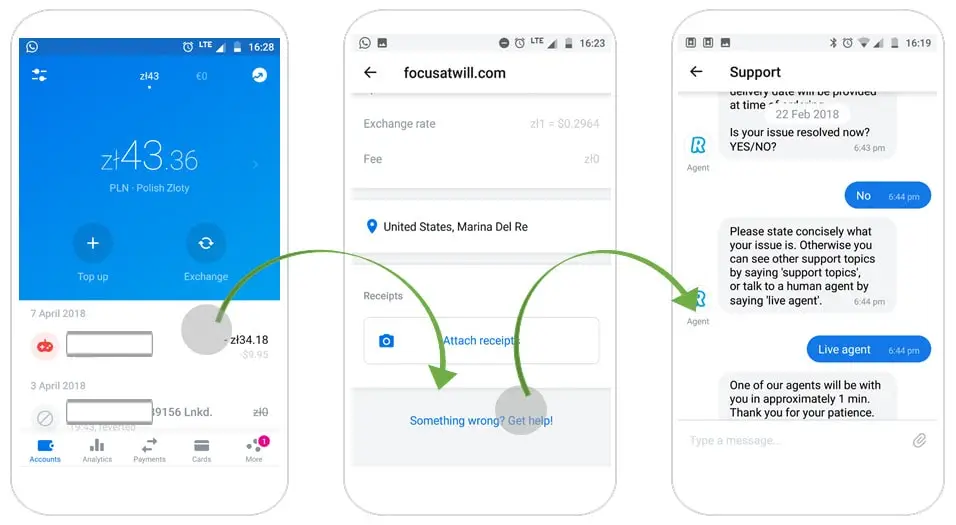

Revolut currency exchange

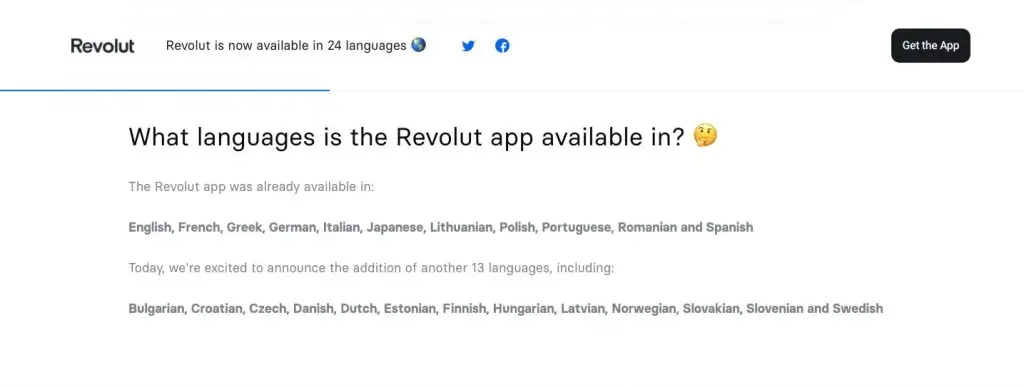

Multilingual Interface

If you just start to create a peer-to-peer money transfer app for payments, you can use a single language. It’s enough for MVP goals – for example, to represent your financial product to customers and investors.

But at later stages, it is worth considering adding multiple languages to a user account. This would help you grow and expand worldwide, attracting more new customers in each country.

Revolut multilingual interface

Support

The support isn’t actually a fintech feature. It is a system of features that guarantee your customers can get help when they have questions or problems.

Your support system should include at least live chat, email, or call features. However, online chats remain the most convenient choice. Your customers can get the fastest support by asking a question in the mobile in-app chat.

When it comes to fintech products, and especially for mobile online banking, it is essential that users feel protected when using a financial product. The support features gradually increase users’ sense of security and encourage them to use the fintech application more.

Revolut customer support

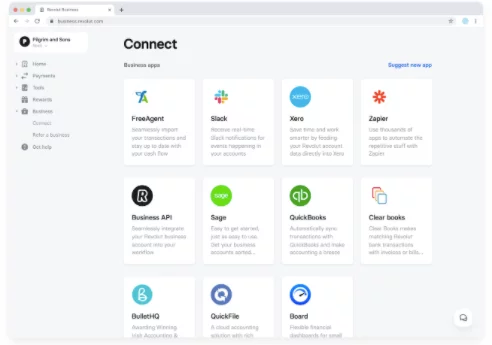

Integrations

Integrations are required to connect with other world banks and money transferring systems via API and other protocols.

Money transferring mobile app can be connected with different banks your customers use to send payments. So they can control their funds using your app.

This way, your customers can access their assets in different places worldwide by using your money transfer app. For example, ICICI Bank offers an API for open banking between banks and customers.

Revolut business integrations

Our Experience

CityFALCON

CityFALCON is a fintech news aggregator. Its score rates financial tweets, news, and authors using Natural Language Processing. CityFALCON makes it easier to monitor financial news and more accessible for traders and investors to receive essential data to make the correct financial decisions.

Our solutions:

Our team and management have delivered many various apps. When we started collaborating with CityFALCON, our client needed to improve an existing project MVP. Our main goals were to create a clean and simple UX, build a scalable architecture, and add a news processing scoring algorithm.

CityFALCON is now a fully developed project that helps people who work with finances, trading, and transactions to build their businesses more effectively. We are proud to say that we exceeded all the initial goals. CityFALCON fully developed iOS and Android mobile systems with voice assistant integration, an NLP-powered news feed, and a cryptocurrency coverage launch.

We have been working with CityFalcon for 5 years now. Also, the project is in the TOP-50 startups of Great Britain awarded by Google and Microsoft and raised $4.7M.

CrowdInvest

CrowdInvest is a social crowd investing application that is created for investment clubs. With this app, users can learn, invest, and collaborate.

The client came to us to create a social crowd investing application for collaborative investment. To start with, we suggested developing an MVP product. Our goal was to first build mobile apps for IOS and Android.

Our Solution

To ensure that the transfer app met all project requirements, our QA engineer needed to do the following:

- Business cycle testing

- Function testing

- Installation testing

- Configuration

- Failover

- Recovery testing

We created the MVP of the CrowdInvest mobile application with clear architecture. A number of features were also added, including:

- Account Registration

- Invites

- email and SMS notifications

- Access to real-time market data.

How To Ensure That Your Money Transfer App is Secure

Security and ease of use to send payments are among the things customers look for when dealing with finances. Anything involving bank transactions or money exchange needs to be treated with care and attention. For apps, it is vital to ensure that the security.

Here are some things to take into consideration when building a money transfer app:

Introducing 3D Security

This is a technology that was introduced by international payment companies like Visa and MasterCard. It is designed to ensure that payment users send online are secured.

Here, the cardholder’s identity needs to be verified before the transaction can be completed. This has significantly helped to decrease fraud and theft.

Non-Stop Monitoring

Transactions that occur on your mobile platform should be constantly monitored to find suspicious activities.

For example, users’ accounts and banking activities can be constantly monitored. If there is a money transfer to a new or suspicious location or odd payments, it is blocked until the user can verify that they are the ones trying to carry out the transaction.

Due to the huge amount of data that needs to be processed, manual transaction monitoring is unfeasible. Keeping that in mind, banks usually implement a suitable transaction monitoring solution to automate this process. This eliminates the chances of human error and increases the speed and accuracy of suspicious activity detection.

Using Biometrics

In the IT field, biometrics involves using a person’s unique features like fingerprint and facial attributes to log into applications or send payments.

Biometric authentication technologies like Face ID and Touch ID are relatively new technologies for the general public. However, they are one of the most secure and user-friendly methods to ensure safety usage of mobile money transfer apps.

Types of Money Transfer Software

Nowadays, money transfer fintech software can be divided into two main categories:

- Outward Remittance – when the money transfer occurs outside the borders of your country. For example, transferring money from your account to the account of a vendor overseas.

- Inward Remittance – referring to money or funds received from overseas or a different country. For instance, getting paid by a client who lives in another country.

Money transfer apps can also be classified based on the needs of your business. That is why you need to have a good understanding of your business requirements before building the app:

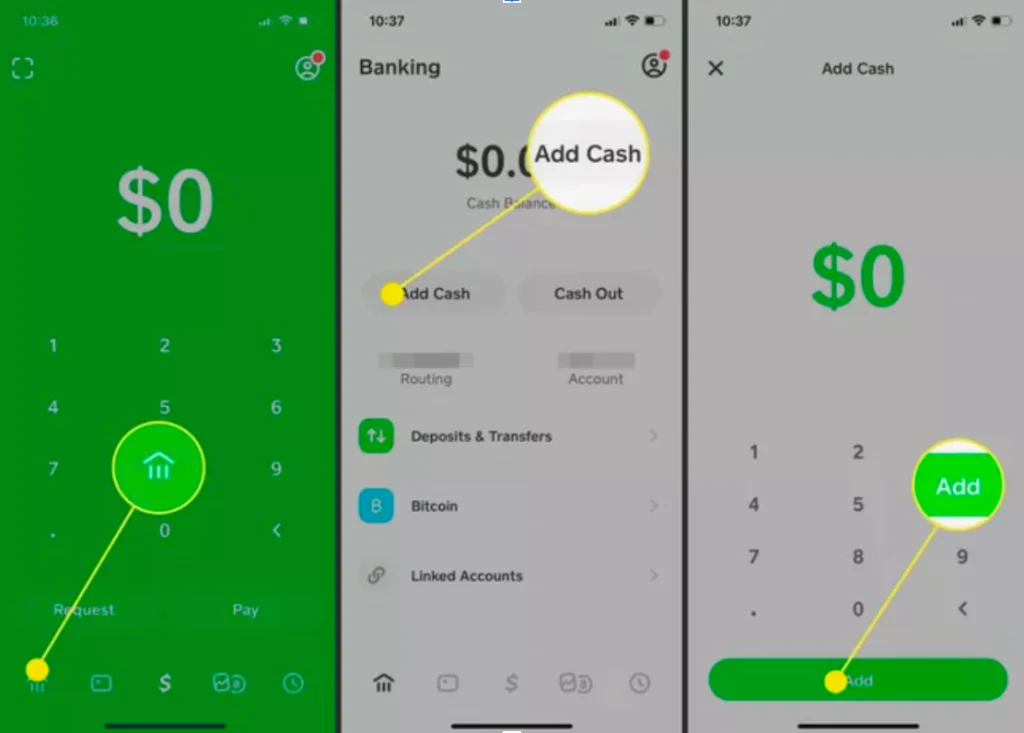

Person-to-Person (P2P) Payment System

A P2P payment app allows the transfer of funds from one individual to another using a trusted payment platform. These types of payments are done with the help of personal computers, smartphones, or tablets. In addition, an internet connection is required for the payment to go through. One of the most used P2P payment systems is Cash App.

CashApp Home Page

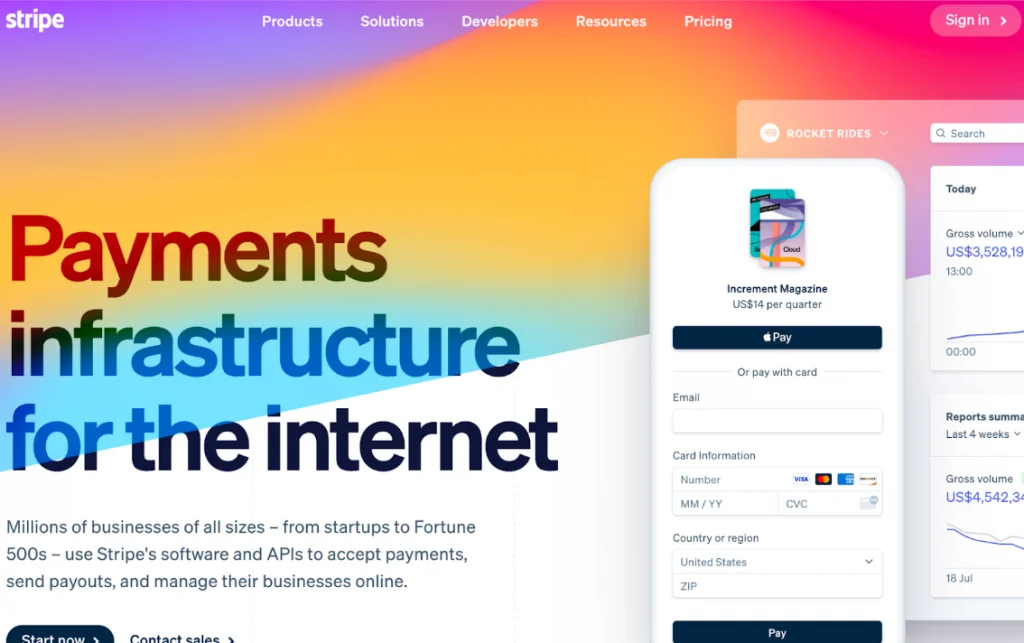

Business-to-Business (B2B) Money Transfer System

B2B is an online method to send payments between businesses. This type of transaction often occurs when a business needs the products or services of another business. A good example of a B2B payment solution is Stripe.

Stripe Home Page

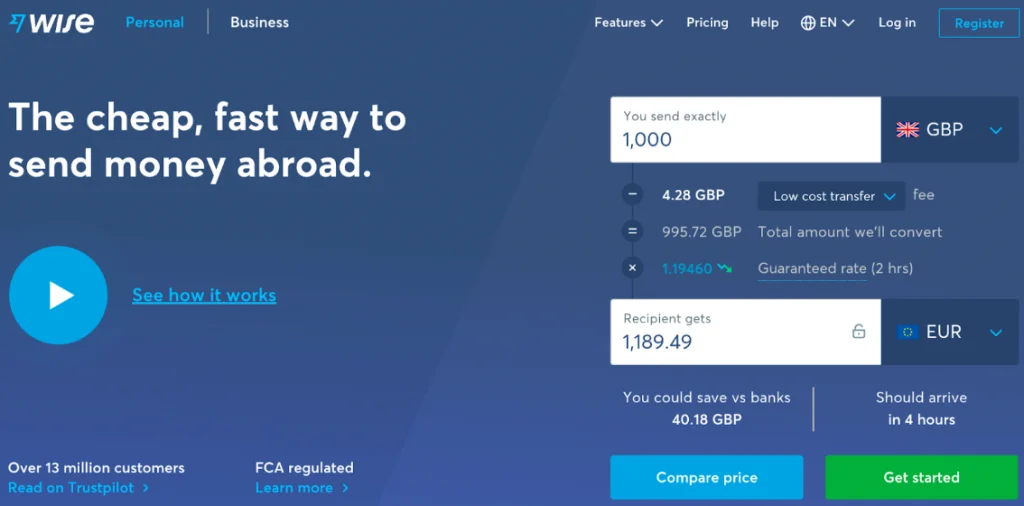

Digital Remittance Services

Digital money transfer apps are gaining popularity in developing countries. People can now easily transfer money to others for a small fee based on the transaction sum. This has made it possible for people to obtain goods and services easily without needing to worry about heavy bank charges and lengthy processes. One of the best digital remittance services is Wise, which is used by millions of people worldwide.

Wise Home Page

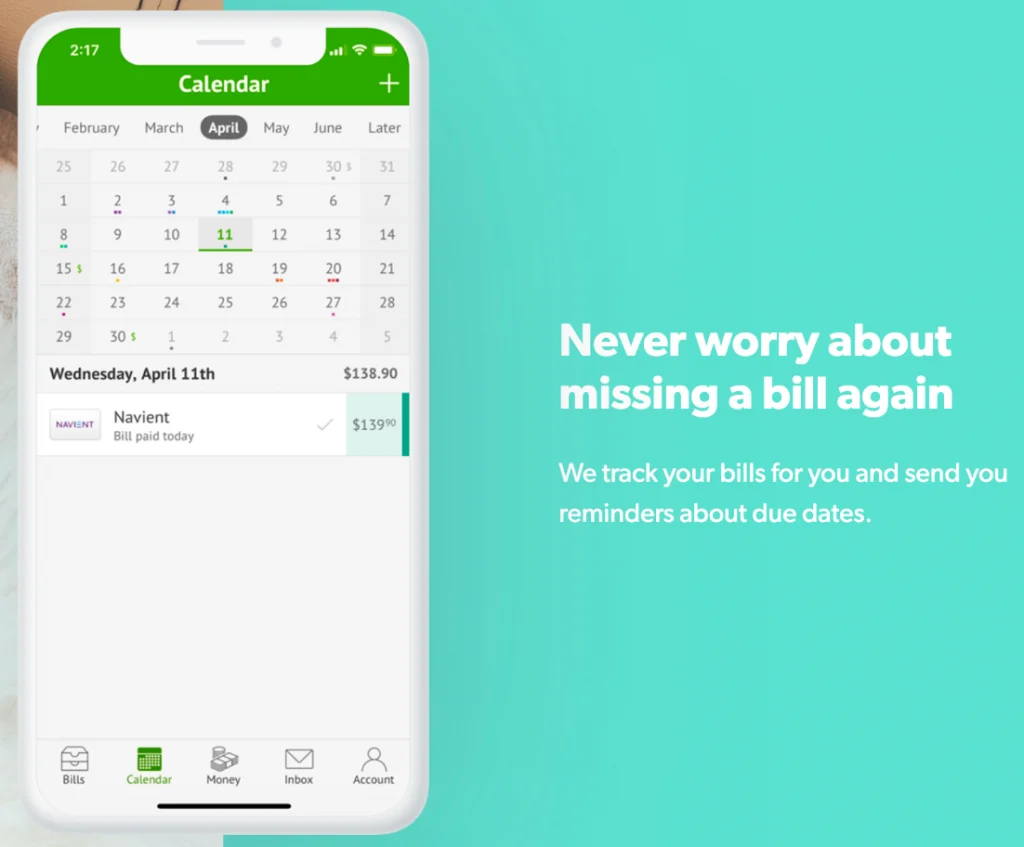

Electronic Bill Payment Services

Electronic bill payment services have made it possible to pay bills online from anywhere in the world. Here, users can use the application to transfer money from their personal credit or debit cards to vendors. In the US, Prism is the go-to app people use to send bill payments.

Prism Home Page

Cost to Build Custom Money Transfer Application

Any app development process is complex. It consists of different stages, and is full of details you should pay attention to. Starting with the discovery phase and first wireframes development, your product will go through the technologies-choosing and features-determination phase. Therefore, make sure you’ve planned all of the below steps:

Number of Features

A complex mobile app, requires more time and money for the development of its architecture. That’s why we always recommend starting with the discovery phase to outpoint the core features you need for a decent MVP.

By starting development only with the core features, you can:

- Save time and money

- Launch faster

- Get your first customers before presenting your product to investors

- Scale quicker

Technology

There are lots of technologies in the mobile app development market. Pay more attention to flexible and scalable tech solutions for development. “Start-up-friendly” technologies like Ruby on Rails, Python, or PHP, allow you to build and scale your product on budget. On the other hand, the more complicated ones like Java will require more money.

It is worth considering the popularity of chosen technology. Popular languages and frameworks provide you with a bigger pool of qualified developers. Remember it as a start-up whose goal is focusing on speed and scalability.

Staff Costs

Labor costs are driven by team size and seniority. It can also be affected by and taxes or office rentals. This can take a big part of your budget.

Need a cost estimate for your money transfer app?

However, you can save some costs by choosing to outsource over in-house. Outsourcing development models allow you to start collaboration at budget prices.

That is why being an offshore development agency, Sloboda Studio can offer competitive rates for the high-quality expertise of the dedicated development teams.

| Company location | Hourly rates, USD |

| The US and Canada | 50 – 250 |

| Australia | 50 – 150 |

| Western Europe and the UK | 35 – 170 |

| Eastern Europe | 20 – 150 |

| India and Southeast Asia | 10 – 80 |

Hourly rates for devs by location

Getting a License

How to create a mobile money transfer app like Revolut? First, you should get a license to ensure your product meets all the law requirements. For example, the European electronic money license applicants should have a detailed business plan, structured organization, good team and risk management, and a minimum mandatory capital of 350 000€.

Legal Costs

Starting a money transferring service, you’ll spend some extra legal costs. Your investors and users will be interested in lots of details about your product. For example, how you’re going to transfer money or how good is the account security. An experienced lawyer can make things simple. However, the prices depend on a particular country.

Marketing

Sometimes vendors pay all the attention to product development forgetting about its promotion. Such an approach is risky because you may lose time if you start the marketing campaign after the development.

Working with start-ups for over ten years, we’d recommend working on software development and promoting one product at a time.

Once you begin implementing the core features, start telling your target audience about your product. In this case, promotion helps to get new interested users. It also makes your product well-known and trusted among your potential users.

Need to create a money transfer platform?

Reasons to Create Your Custom Money Transfer Software

Based on the data obtained and the number of money transfer apps, the question pops up – Why should businesses create a money transfer application?

Everything is Moving Online

Our modern world is changing: people have less time to stay in one place for too long. Everything is moving online, revolves around apps, and becoming more mobile.

Why use an old-fashioned bank with its physical branches and queues?

A better option would be to use a smart mobile app that allows people to transfer money and make other payments.

Banking digitization makes it easier to use money transfers and online payments. But that’s not all.

Money transferring software like Revolut also allows its users to use such expanded feature functionality as insurance, blockchain, cryptocurrencies, splitting payments, or virtual saving accounts — all within a single mobile fintech application.

Growth of Demand

It’s been 7 years since Revolut was born. Since then, many neo-banking fintech applications have appeared, and many vendors have started building a peer-to-peer payment app infrastructure. These days, you can see that the demand for fast payment has grown significantly and still prevails over the supply.

Online Banking for Business Needs

Nowadays, money transferring fintech software can be used not only by individuals but by businesses, too. The development of a mobile money transfer app can come in handy not only for regular customers but also for businesses. This makes a great opportunity for building new business collaborations and continuing to grow the neo-banking apps segment.

What is a Money Transfer Software?

A money transfer app is a system enabling its users to perform banking transactions using cashless modes of payment, with multi-bank fearure and multi-currency options. Moreover, such a fintech application, unlike traditional banks, is available at any time.

A money transfer app like Revolut is considered “neobanks”. Neobanks operate exclusively online and do not have any physical branches, allowing them to provide their customers with the fastest digital and mobile financial apps, and allowing customers to pay, send, or lend money online.

The Revolut app is among the top money transfer apps worldwide and was founded in 2015. In the 5 years since then, it is clear that the idea of neo-banking and money transferring fintech software is a popular, profitable, and growing industry.

Every day, the demand for money-transferring services continues to grow as data shows. Transaction value in the Digital Remittances segment is projected to reach $55.68bn in 2022 with an annual growth rate (CAGR 2022-2026) of 7.24%.

Building a money transfer app?

Final Thoughts

To ensure that the app brings in profits, apply for a minimum viable product (MVP). It will contain all the core features of the app. Also, it shows users what they will get when the final version comes out. The MVP can also be used to attract investors.

Still, have questions? At Sloboda Studio, we have been transforming business ideas into code and apps. And have been actively providing solutions to real-world problems for 14 years. Creating money transferring fintech software is a fascinating process that Sloboda’s experts can simplify. Working with us is always worth it; just look at Revolut. Businesses can go online, and traditional banking is already digital.

Ready to build a product similar to the Revolut app? Follow these three steps!

1. Think about your business plan and monetization.

2. Evaluate the core features you should implement first

3. Ensure your product follows all necessary legal requirements.

Are you interested in building a money transfer app? Book a free consultation with us.

Frequently Asked Questions

How do you ensure the security and privacy of transactions in the app?

Security and privacy are paramount for any money transfer app. Here’s how to prioritize them:

- Data encryption: Use industry-standard encryption protocols to protect sensitive user data like financial information and transaction details.

- Multi-factor authentication: Implement multi-factor authentication (MFA) for logins and transactions, adding an extra layer of security.

- Regulatory compliance: Adhere to relevant financial regulations and data privacy laws like GDPR and CCPA.

- Secure servers and infrastructure: Utilize secure servers and infrastructure to protect against unauthorized access and breaches.

- Transparent privacy policy: Clearly explain how user data is collected, used, and protected in a readily accessible privacy policy.

- Regular security audits: Conduct regular security audits and penetration testing to identify and address potential vulnerabilities.

- User education: Educate users about best practices for secure app usage, such as strong passwords and avoiding suspicious activities.

By prioritizing these features and security measures, you can build a money transfer app that users trust and rely on for their financial transactions.

What are the key features of a successful money transfer app?

A winning money transfer app needs a blend of convenience, security, and functionality. Here are some key features:

- Easy and intuitive interface: Sending and receiving money should be effortless, with clear navigation and minimal steps.

- Multiple payment methods: Offer options like bank account transfers, debit/credit cards, and mobile wallets for flexibility.

- Competitive exchange rates and fees: Transparency and competitive pricing are crucial, especially for international transfers.

- Fast and reliable transfers: Users expect speedy transactions, with clear estimates and updates on transfer status.

- Multiple recipient options: Enable sending to contacts, phone numbers, or email addresses for convenience.

- Transaction history and tracking: Provide a clear overview of past transactions, with details like date, amount, and recipient.

- Security features: Implement robust security measures like multi-factor authentication and data encryption to ensure user safety.

- Bill pay and other features: Consider additional features like bill pay, splitting bills, or investment options to enhance user value.

How much does it cost to create a money transfer app?

The cost of building a money transfer app will significantly vary depending on its features and other factors, including project specifications. So, the cost will be calculated based on the features that are added to the app.

How do I start a money transfer service?

First, you need to get a license to be able to provide money transfer services. Also, most countries like the US will need a way to monitor the business to ensure that you are not money laundering.

Now, start your business once the license is ready. However, you need to decide if the business should be online or have a physical presence, or both. It is good to weigh the pros and cons of each option.

It is also good to create relationships with banks since your business will be transferring money to them.

How does a money transfer app work?

Money transfer apps help users carry out bank transactions, currency exchange, and other financial activities online. Unlike traditional banks that have a closing time and physical location, these apps allow users to do transactions at any time, worldwide.