How to start a real estate crowdfunding business?

Before we answer this question, let’s check some statistics. According to Statista, the global real estate market is expected to reach an impressive $654.40 trillion by 2025. Among its various segments, residential real estate is set to lead the way, with a projected market volume of $534.40 trillion that same year. Where is the Commercial Real Estate market headed? Well, it’s on track to reach an incredible US$120.02 trillion by 2025!

There’s a reason for that. There was a 2.5 times growth in demand for passive income over the last 5 years. And investing in real estate is a core time-tested source of getting passive earnings.

Real estate crowdfunding platforms made real estate investments widely available and affected market growth.

Analyzing the tendencies, we can see that creating a real estate platform is one of the most alluring business ideas in 2025 and beyond. We share some interesting stats on it below.

To help you successfully launch your own real estate crowdfunding platform, we’ve outlined seven essential steps:

- Understand what real estate crowdfunding is

- Analyze the market

- Learn from top industry players

- Get familiar with crowdfunding regulations

- Clearly define your niche

- Consider the key features of your MVP.

- Assemble the right development team

Read on and you’ll find it all out.

Our Pre-Built Crowdfunding Solution

When considering how to develop a real estate crowdfunding platform, using a semi-finished solution offers a compelling middle ground between custom development and off-the-shelf SaaS platforms. This approach combines the flexibility of custom development with the speed and cost-efficiency of a pre-built foundation.

We have a partially built crowdfunding solution that provides a robust base that can be tailored to your needs without starting from scratch.

The advantages are clear: significantly reduced development costs, typically ranging from $15,000 to $30,000, compared to fully custom options, which are often far more expensive. Additionally, the time to launch is substantially shorter – 2 to 3 months, allowing you to enter the market quickly and start generating value sooner. This accelerated timeline is ideal for testing and refining your platform while staying within budget.

Unlike rigid SaaS platforms, semi-finished solutions offer flexibility in adding custom features, integrating external APIs, and scaling as your business grows. This approach strikes the perfect balance, ensuring you launch a high-quality, functional product tailored to your unique business goals without excessive costs or delays.

Pre-Built Crowdfunding Solution

Launch Your Crowdfunding Platform Fast

Top Real Estate Accredited and Non-Accredited Crowdfunding Platforms

Fundrise

Fundrise is a Washington-based real estate crowdfunding platform. It allows investors to search some real estate opportunities based on their investment preferences. On Fundrise, investors can:

- manage and track their real estate investments online

- receive regular financial reports.

Fundrise was founded in 2010 and attracted around $55.5M of investments in 7 rounds of fundraising.

As a monetization model, Fundrise chose to charge accredited investors a service and asset management fee of between 0.3% and 0.5% of the invested capital amount annually. Additionally, Fundrise charges a one-time 1% to 2% origination fee and a $5,000 due diligence and closing cost, no matter whether the project is approved or not.

For submitting a project for raising funds, Fundrise examines every project by following a rigorous due diligence process. Roughly, less than 1% are approved.

What’s interesting about Fundrise is that it pre-funds projects with its own capital before offering them to investors.

Fundrise is the most visited real estate crowdfunding site on our list. In December 2024, Fundrise recorded about 554,400 monthly visits.

Realty Mogul

Founded in 2012, Realty Mogul is a Los Angeles-based real estate crowdfunding site that fundraised approximately $45.1M. The website connects accredited investors with property developers.

Realty Mogul has crowdfunded over $200M and has 80,000 accredited investors registered on their website.

The platform is only designed for accredited investors. It has 2 possibilities of real estate investments for accredited investors, namely equity and debt.

The minimum investment amount is $5000 with a yield of 6-24%.

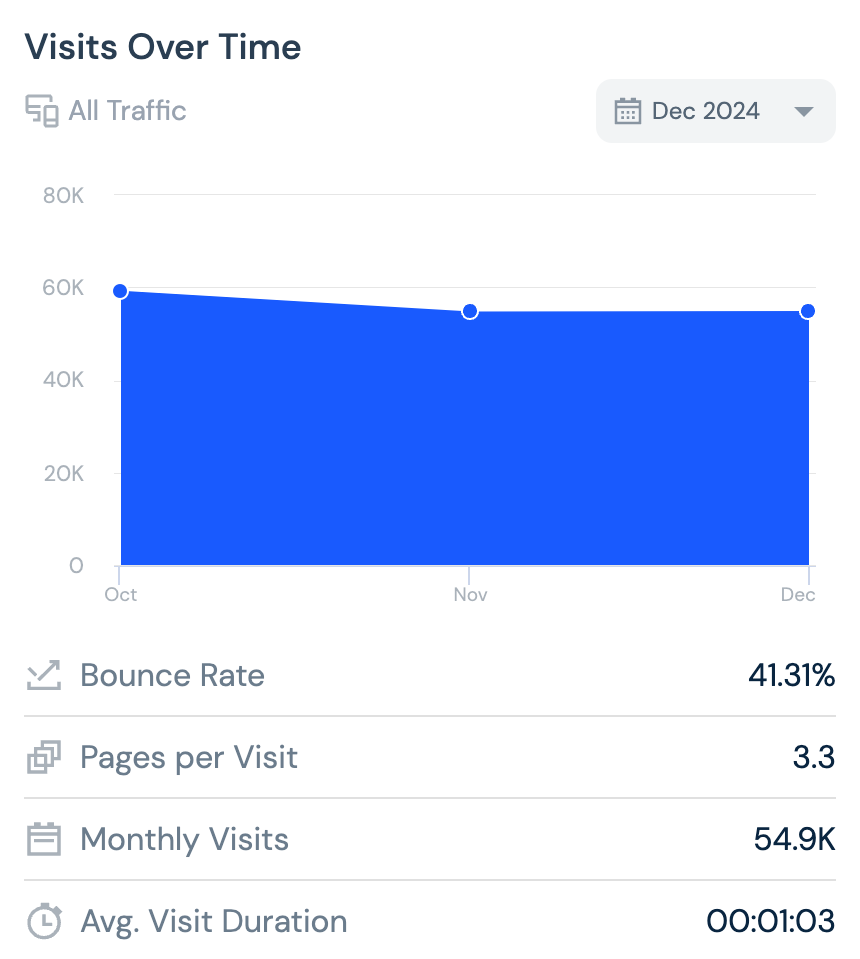

As for monthly traffic, RealtyMogul received about 54,900 visits in December 2024.

CrowdStreet

CrowdStreet is a commercial real estate platform that provides online commercial real estate investment offerings for investors. Founded in 2013, CrowdStreet raised $24.9M in 4 rounds of funding.

The company crowdfunded over $1B in total online investments and has around 80,000 investors. Since the launch, investors who have invested on CrowdStreet have received over $100 million in returns.

On CrowdStreet, the minimum investment amount is $25,000. The invest period is 3-7 years with a yield of 10-20% per year.

Cadre

Cadre is a real estate investment platform in crowdfunding that matches operators of real estate with investors. Based in New York, it raised $133.3M in just 6 years.

As for Cadre’s way of monetizing its platform, it charges recurring management fees versus one-time transaction fees.

Going to build a real estate crowdfunding platform?

The 7 Core Features for Investors on a Real Estate Crowdfunding Platform

We have analyzed the top real estate platforms and have gathered the 7 core features that every real estate crowdfunding platform should have.

Plus, we’ll share the peculiarities of those must-have features of real estate crowdfunding platforms.

Registration

Real estate crowdfunding platforms usually allow both investors and property developers to register.

However, there are some crowdfunding platforms like Fundrise, for example, that only allow investors to register.

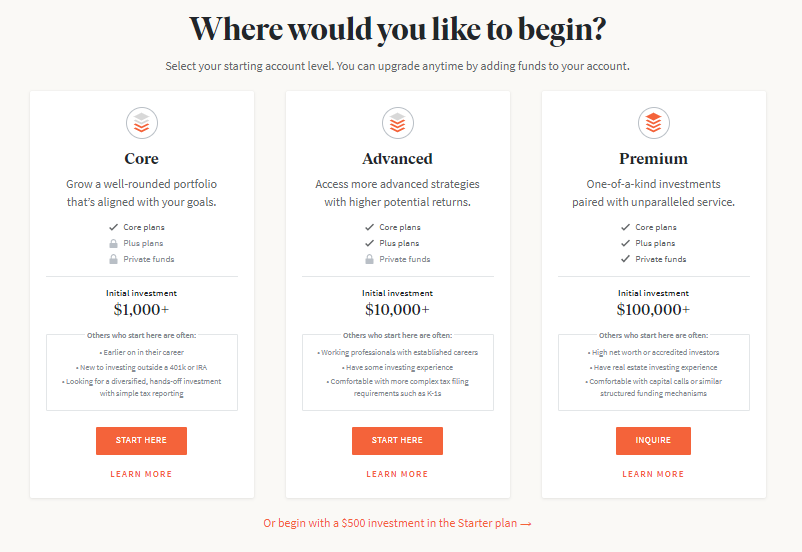

You can make a registration process as complex as you wish. There are 2 possible scenarios:

- The complex registration process, like Fundrise and Realty Mogul, did but a relatively easy investment process

- A quick registration, but a very thorough investment submission, like Prodigy Network and CrowdStreet did.

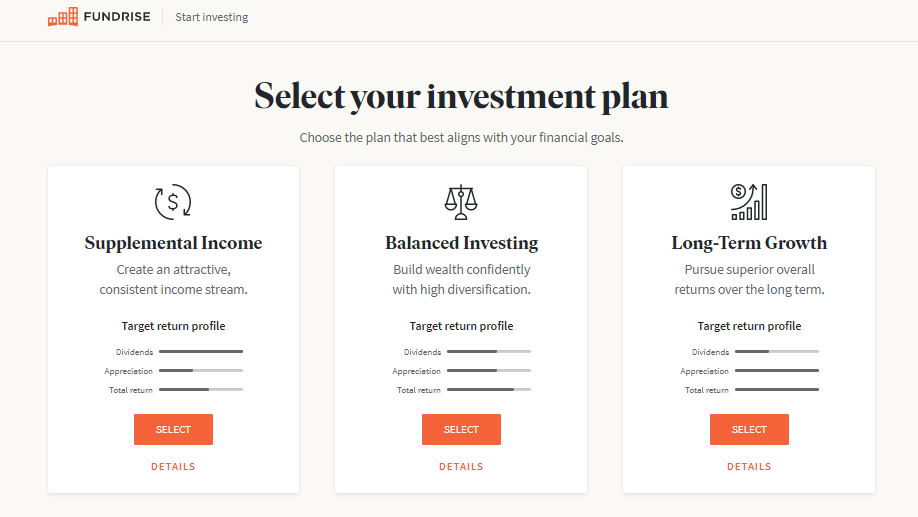

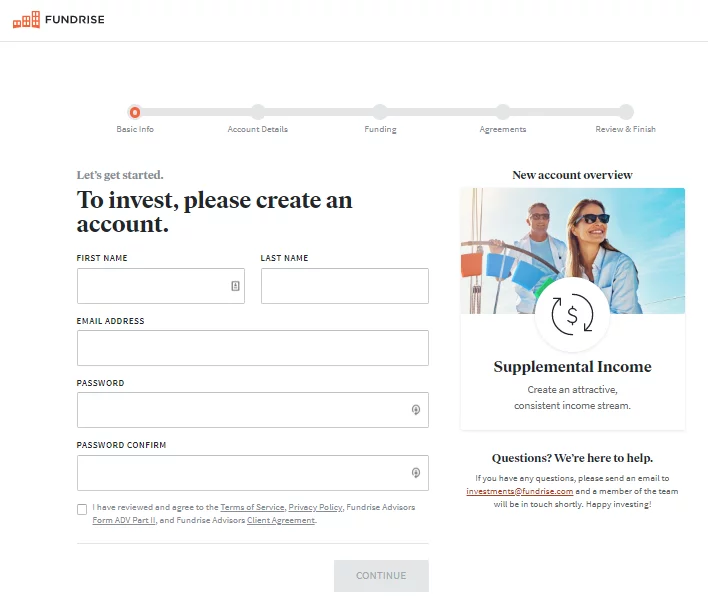

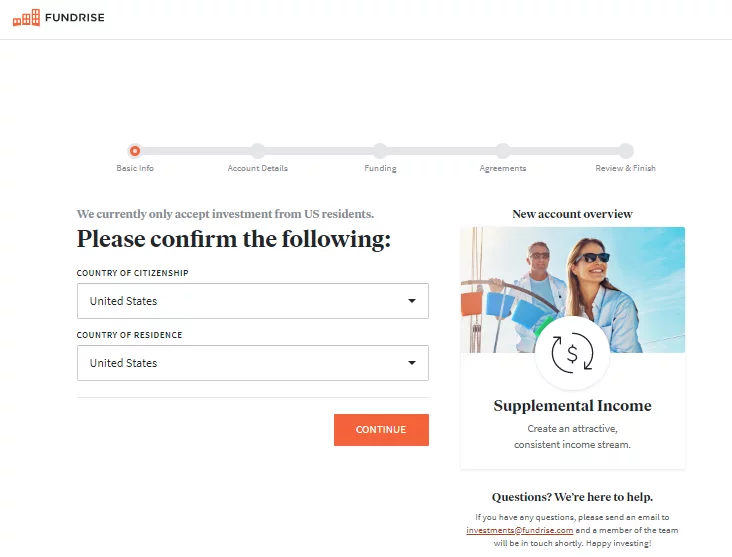

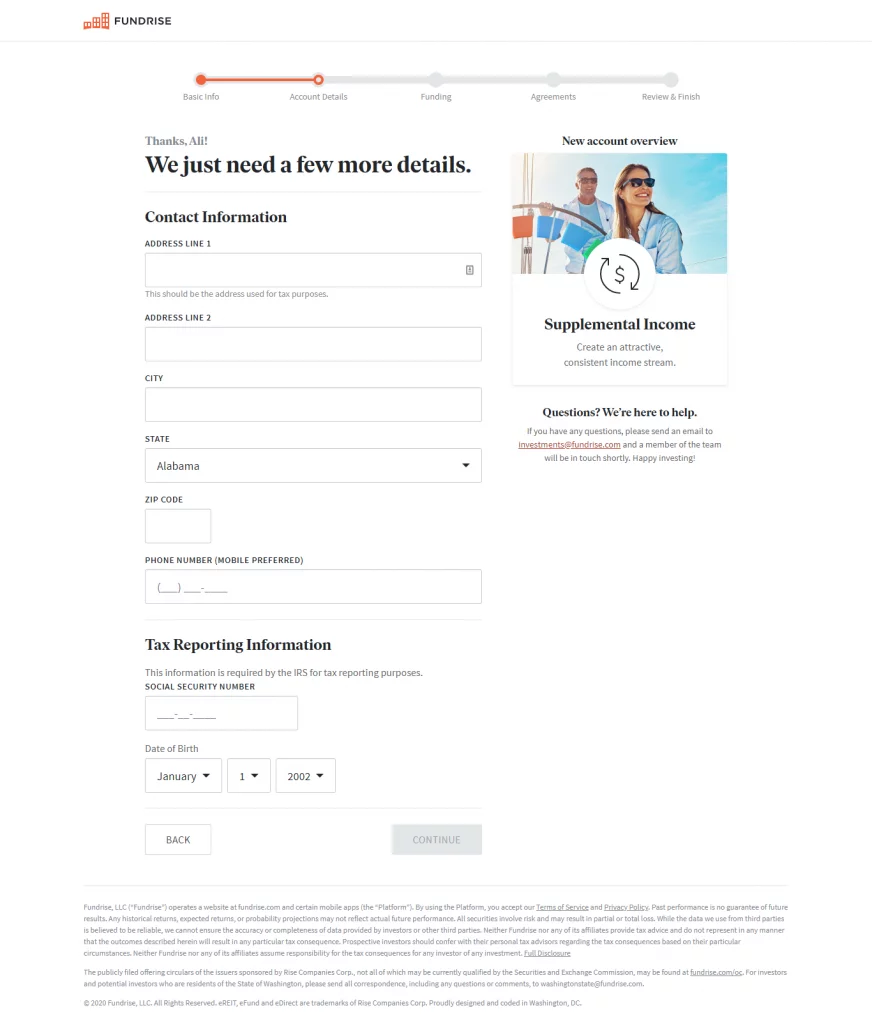

A step-by-step complex registration process:

- Selecting an account level, depending on the investor’s competence.

- Choosing an investment plan.

- Entering first and last name, email, and password, and agreeing to the platform’s terms and conditions.

- Confirming the country of citizenship.

- Picking an account type.

- Indicating contact information and tax reporting information.

- Choosing the desired amount to invest.

- Selecting a source of funds.

- Linking a bank account.

- Agreeing to all terms and conditions.

- Reviewing the stated information and finishing the registration process.

By creating a quick registration process, you can provide users with the ability to:

- register via Facebook, Google, or LinkedIn, or

- ask them to include their first and last name, country, email, and telephone number.

It is also important to include a checkbox to agree to the companies’ terms and conditions for either type of registration. After registering a user on the platform, send a confirmation email.

Moreover, most online real estate platforms in crowdfunding have a disclaimer during the registration process.

Login

Usually, a login is made to grant platform access to already registered users. You can either offer them to log in with:

- a preferred social media account

- their email and password.

Authentication

Authentication is a process of recognizing a user’s identity

For security reasons, we recommend you offer a two-factor authentication process.

Fundrise, for instance, provides an investor with a security code and requests them to enter the code in addition to their password every time they log in to their own account.

Moreover, Fundrise notifies by email and text message when a login is detected from a new device.

Authorization is a process of verifying the users’ permissions in operating the platform. An authorization process is carried out with the help of social networks, such as Facebook, Google, or LinkedIn.

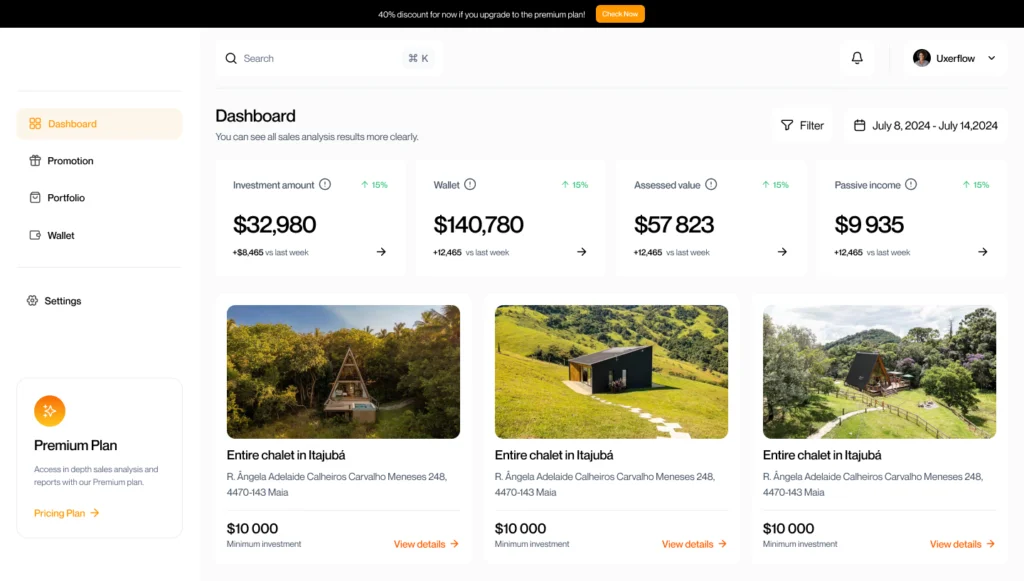

Investor’s Dashboard

The investor’s dashboard is the feature that helps to invest and to get information and see how much they have earned and invested.

The investor’s dashboard should include:

- Total earned to date

- Date of becoming an investor on the platform

- Earnings (dividends, appreciation, advisory fees)

- Total amount of active projects

- Investments overview – active and past

Search

Lots of crowdfunding real estate platforms allow a user to search for real estate investment opportunities only after the user is registered.

Usually, investors can search by name, country, city, or property developer.

Property Listings

A property listing is a list of registered properties with the necessary information included by a property developer who is seeking what to invest.

Such lists show the number of active and completed projects. Investors should be able to view listings either as a list, grid, or on a map.

Each listing on a page should have:

- Short description of the real estate

- Photo

- Location

- Name of the property developer

- Platform’s rating

- Projected return

- Estimated holding period

- Ability to add the project to favorites

If you have a lot of listings, then sorting and filtering will be a great help to the users.

Common parameters for sorting:

- Risk rating

- Equity assets first

- Recently acquired

- Debt assets first

- Recently posted

- Investment high to low

The most common filters are selected by:

- City

- State

- Zip

- Returns

- Deal terms

- Offerings

- Sponsors

- Eligibility

Furthermore, a property listing page can offer sponsors the ability to download listings in an Excel table. And you can also introduce tags for each property listing.

Property Page

The real estate page is a page that should be visually appealing and, most importantly, easy to navigate.

Some major features a real estate page should have:

- Photo/map

- Location

- Property developer

- Description

- About the building, building plan

- Some key factors – rating, total commitment, status projected return

- Graphic of risk-adjusted return

- Market analysis

- Capital stack

- Project timeline (when a property was acquired, updated, etc.)

Investing Process

The crowdfunding real estate investing process should be quite detailed and comprehensive, and should include:

- Who is investing – individual or entity

- Investor’s personal information

- Payment information

- Agreements, acknowledgments, and signature

- Review of the information stated before

In order to confirm the information, an investor needs to send the first page of their bank statement, showing their account number and the name of the account holder.

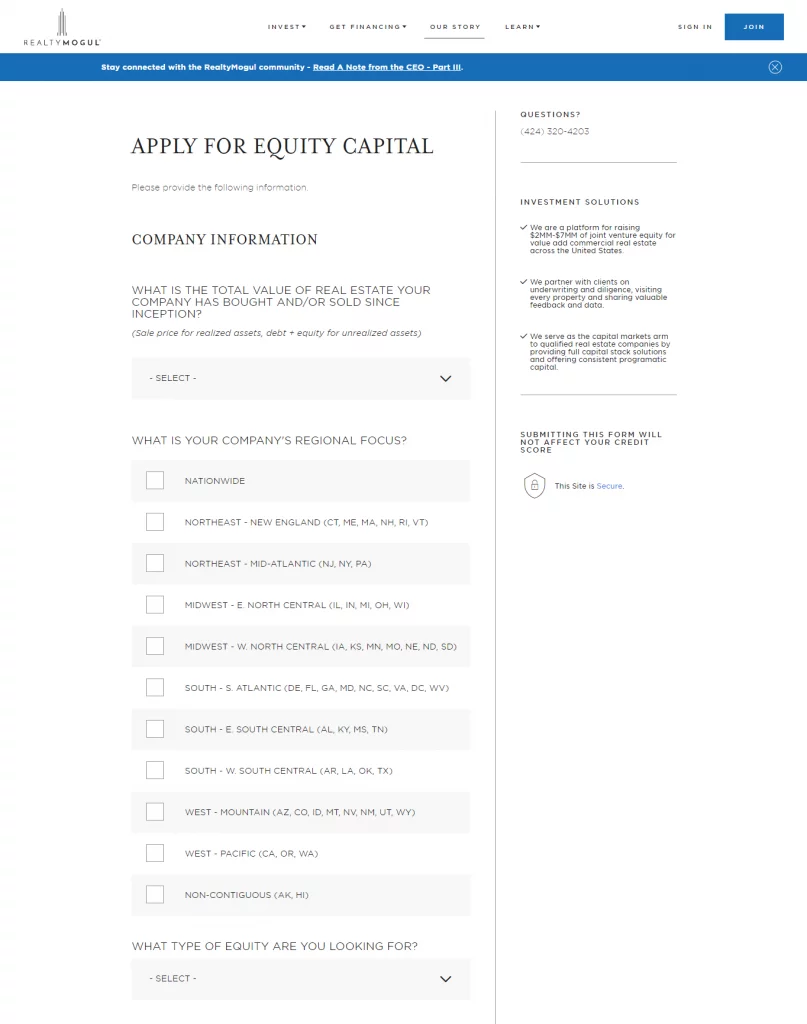

Application Form

Not all crowdfunding sites for real estate have a submission form for property developers (sponsors). The reason why is that they usually get in touch with companies directly.

If you would like to implement an application form make sure to include:

- Company information

- The total value of the real estate

- Company’s regional focus

- Type of equity a sponsor should have

- Transaction information

- Business purpose of the equity financing request

- Asset type of transaction

- Amount of equity to raise

- Expected cash-on-cash return

- Expected investor level IRR of the project

- Property address

- Contact information

- First and last name

- Company name and website

- Phone

How to Start a Real Estate Crowdfunding Platform

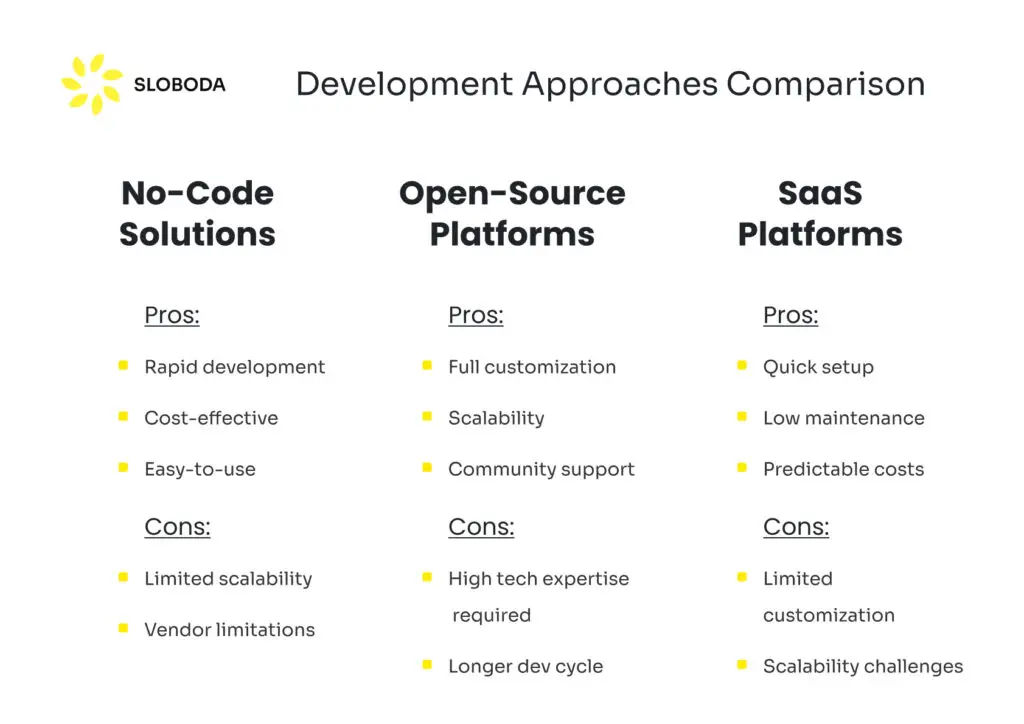

When starting a real estate crowdfunding platform, there are three key approaches to consider: no-code, open-source, and SaaS. Each has its unique strengths and challenges, making it essential to choose the right one based on your goals, timeline, and budget.

No-Code

No-code platforms empower you to create a real estate crowdfunding platform without requiring programming skills. With pre-built components and visual editors, you can quickly design and launch your platform. At our company, we offer a half-baked solution tailored for launching an MVP and validating your idea efficiently.

- Advantages: Rapid development, cost-effective, and perfect for testing your concept in the market. With our half-baked solution, you can get up and running in just a few weeks.

- Challenges: May have limitations in scalability and customization for long-term growth.

- Best for: Entrepreneurs and startups seeking to launch quickly, validate their idea, and make data-driven decisions for future scaling.

Launch Your Crowdfunding MVP in Weeks

Open-Source

Open-source solutions give you full access to the code, allowing you to customize and scale the platform to your exact specifications.

- Advantages: Highly flexible and adaptable to complex business requirements. Free access to the code.

- Challenges: Requires a skilled technical team, a longer development cycle, and higher maintenance efforts.

- Best for: Businesses with technical expertise aiming to build a fully customized and scalable platform.

SaaS (Software as a Service)

SaaS platforms offer ready-made solutions that can be accessed via subscription, enabling quick entry into the market.

- Advantages: Fast setup, low upfront costs, and ongoing maintenance handled by the provider.

- Challenges: Limited customization and potential long-term dependency on the SaaS provider.

- Best for: Small businesses or individuals seeking a cost-efficient and low-effort way to establish their presence.

Choosing the right approach depends on your priorities, whether it’s speed, flexibility, or long-term scalability.

Real Estate Crowdfunding Market

The Real estate crowdfunding market is forecasted to account for approximately $868,982 million by 2027. This means that in the upcoming years, there will be some major real estate investments happening and the market will have enough space for new platforms.

According to Crowdfund Capital, in 2006 there were over 125 real estate crowdfunding platforms. Today you can already find over 30 000 companies dealing with real estate investments and crowdfunding all over the world.

Statistics of the Real Estate Crowdfunding Market

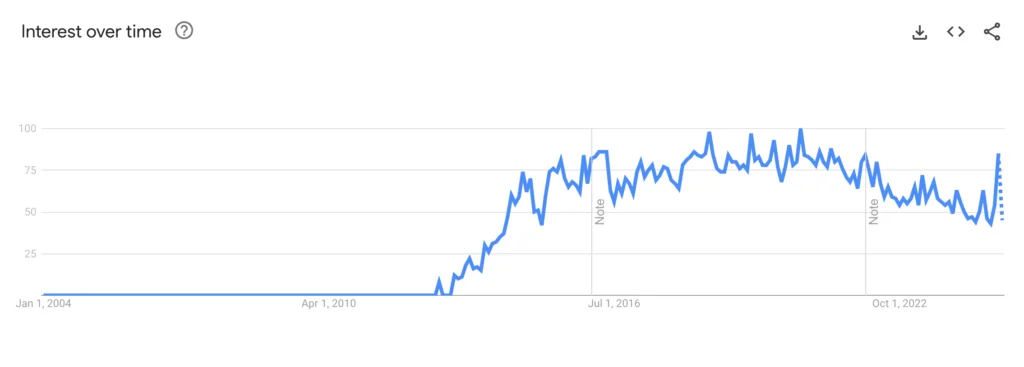

There has also been an increase in interest in real estate crowdfunding and how it helps people to get a passive income. Since September 2013 the search for crowdfunding platforms in Google Search has been growing very rapidly.

Google Trend graph: ‘real estate crowdfunding‘ search term

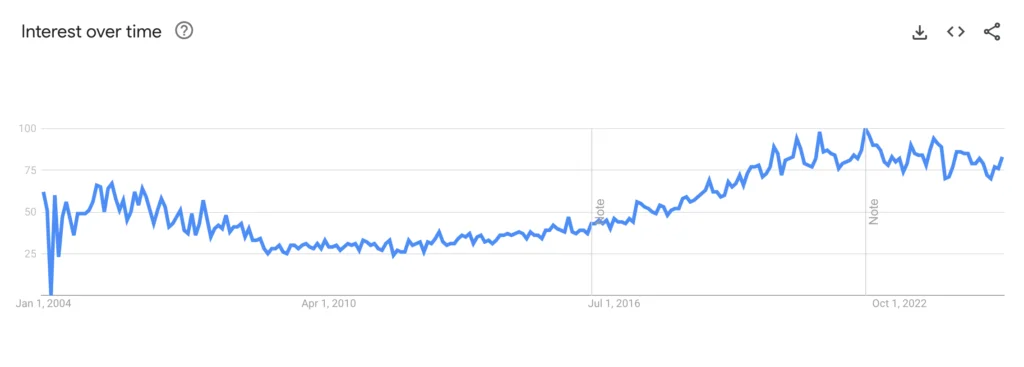

Around that time the trend for passive income also started growing rapidly.

Even more interesting is that investments in the real estate market have increased enormously since 2013. This all can be explained by the fact that, in 2012, crowdfunding became available not only for big but also for small businesses, thanks to the JOBS Act.

Google Trend graph: ‘invest in real estate‘ search term

And, no wonder, since 1971, the average annual return from Real Estate Investment Trusts, or REITs, is 9.72%. The global Commercial Real Estate market is expected to soar to an impressive value of $120 trillion by 2025.

Opportunities in Commercial Real Estate Investment:

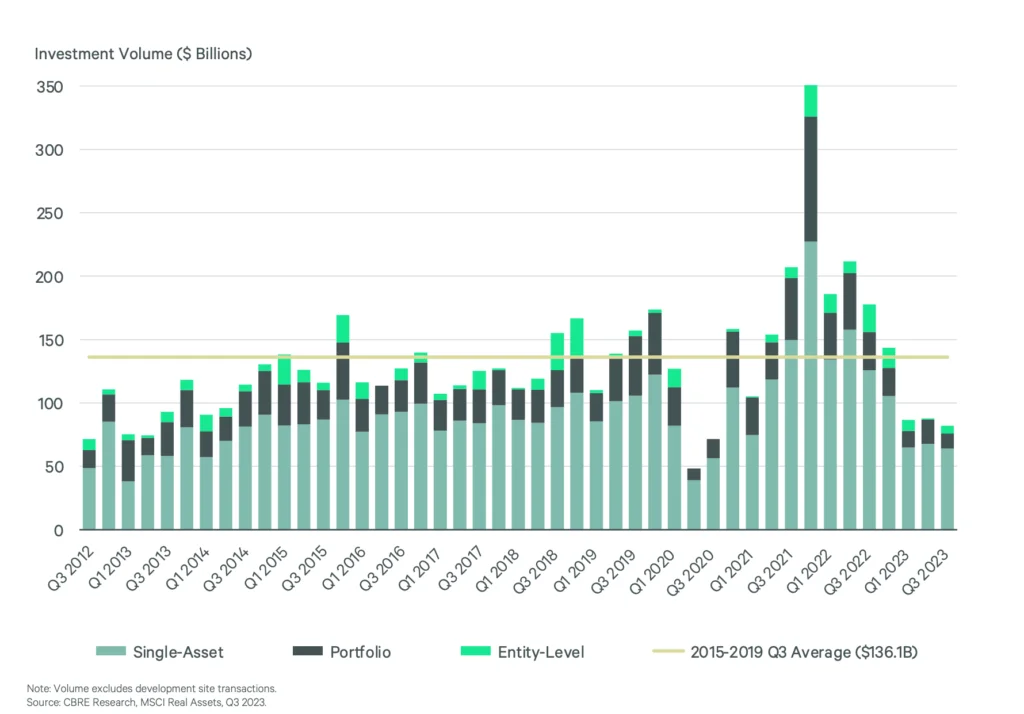

- The U.S. commercial real estate market saw $82 billion in investment in Q3 2023, reflecting a reset in pricing and opportunities for value-driven investors.

- Over the last year, total investment reached $400 billion, providing a solid foundation for future growth as the market adjusts to new financing conditions.

- With higher financing costs, entity-level transactions in Q3 reached $6 billion, creating opportunities for strategic investors to target key acquisitions.

- Single-asset deals accounted for $64 billion in transactions, while portfolio investments totaled $12 billion, offering plenty of chances to focus on individual assets or diversify with grouped purchases.

As the market shifts, it’s a great time for CRE investors to find undervalued assets and position themselves for long-term gains.

Source: CBRE

What is Real Estate Crowdfunding?

Real estate crowdfunding is the practice of financing a project by raising funds from multiple accredited and non-accredited investors.

On one hand, crowdfunding is great in a sense because it allows companies to even raise funds at all, and they can do it more easily. On the other hand, investors are able to become shareholders without spending much or buying a property to get a return.

History of Real Estate Crowdfunding

The concept of crowdfunding was first referred to in an article in 2006 in Wired magazine by Jeff Howe. However, real estate crowdfunding started to be noticeable and used in 2012 with the Jumpstart Our Business Startup Act (JOBS Act).

It is a law that allows small business startups to participate in crowdfunding in the USA and has been growing and developing quite rapidly. However, it is thought that real estate crowdfunding is still in its infancy and is yet to expand.

Real estate crowdfunding emerged due to the 2008 economic crisis when the global economy had some major setbacks. It was decided then that crowdfunding in the real estate industry may change the situation in the USA since it was known that small-sized businesses have always driven the American economy and funding them may help the economy to regain its strength.

The crowdfunding model dates back to 1997 when the rock band Marillion was looking for sponsors to finance a tour after their album release.

Real estate crowdfunding can be either equity- or lending-based. On equity-based real estate crowdfunding platforms, accredited investors collect an equity stake when they finance a project in residential or commercial properties. Returns are a share of the rental income generated by the property or of their capital gains. Investors typically receive payouts once every quarter.

On landing-based real estate crowdfunding platforms, accredited and non-accredited investors invest in the mortgage loan associated with a property. Loans are repaid either every month or every quarter with interest, giving a percentage to each investor taking part in the deal.

Conclusion

To sum up, the real estate crowdfunding industry is a rather new industry that has years to come before it fully blossoms. Nevertheless, there are already some major players in the field that have already crowdfunded millions of dollars for some big real estate investments.

One of the biggest choices when considering creating a real estate crowdfunding platform is its functionality and development approach. There are 3 main ways to know how to start a real estate crowdfunding platform: open-source, no-/low-code development, and SaaS.

One of our company’s core domain focuses is real estate. We’ve built numerous software for real estate businesses.

To streamline the development process, we also offer a pre-built, customizable crowdfunding platform that can be tailored to your needs, helping you launch faster and more efficiently. The next successful platform could be yours!

Frequently Asked Questions

How do real estate crowdfunding companies make money?

To monetize, the real estate crowdfunding companies charge fees, including recurring management fees, one-time transaction fees, service fees, and asset management fees.

What are the advantages and disadvantages of crowdfunding?

Crowdfunding advantages include the ability for businesses to grow as they get fundraised, to receive more loyalty and exposure, build the community, find the first customers, and pitch the product more easily. At the same time, disadvantages comprise information disclosure, risk of public failure, commissions, and limits to only $1M per year.

How can Sloboda Studio ensure my platform stands out from competitors?

We specialize in tailored solutions that align with your business goals. Our expertise in real estate technology allows us to integrate innovative features like AI-driven property recommendations, advanced analytics, and intuitive user interfaces.

Can I start with a no-code or half-baked solution and scale later?

Yes! We can help you launch a minimum viable product (MVP) quickly and transition to a scalable custom solution as your business grows.

How does Sloboda Studio ensure security and compliance for my platform?

We adhere to global security standards and regulatory requirements, including GDPR and SEC regulations. Our team implements robust measures like two-factor authentication, encrypted transactions, and rigorous data protection protocols.