“How to create a rideshare app?” – that’s the question thousands of entrepreneurs and developers are asking as the on-demand mobility market experiences unprecedented growth.

According to the latest market research, the global ride-hailing market is valued at $270.81 billion in 2024 and is projected to reach $301.52 billion by the end of 2025, with continued expansion forecasted at a CAGR of 11.34% through 2033. The ride-hailing segment alone is expected to hit $179.70 billion worldwide in 2025, growing at 5.06% annually to reach $229.98 billion by 2030.

These aren’t just numbers – they represent opportunity. According to Statista, the global ride-hailing market is projected to reach 2.31 billion users by 2029 (up from 1.7 billion in 2023), with an average revenue per user of approximately $97.32. This represents a significant market expansion, creating substantial opportunities for new platforms.

But here’s the challenge: The market is crowded. To succeed, you need more than just an Uber clone. You need:

- A clear competitive advantage (UVP) that solves real market pain points

- Updated technolog that scales with demand

- Smart business strategy that differentiates you from established players like Uber (93 million monthly users), Lyft (31% market share), and emerging regional players

This comprehensive guide walks you through everything you need to know about how to build a rideshare app in 2025, from initial market validation to launch and scale. Whether you’re a startup founder, investor, or developer, you’ll discover the exact steps, features, tech stack, timelines, and costs needed to create a competitive ridesharing platform.

To create a rideshare app, begin by identifying the app’s purpose, target audience, and unique features. Design an intuitive interface for drivers and passengers. Develop essential features like real-time tracking, driver/passenger matching, payment integration, and ratings/reviews. Build a secure backend infrastructure. Test, refine, and finally launch the app. Here’s the proven 8-step process that separates successful apps from failed ones.

Step 1: Market Research & Competitive Analysis

What to do:

- Identify your target audience and their specific pain points

- Analyze direct competitors (Uber, Lyft, regional players in your market)

- Identify indirect competitors (traditional taxis, public transit)

- Define your Unique Value Proposition (UVP) – what makes you different?

- Validate your idea through surveys, landing page tests, or user interviews

- Determine your geographical focus (city, region, national, or international)

Why it matters: 91% of failed startups cite “lack of market need” as the reason for failure. This phase saves you from building something nobody wants.

Step 2: Define Core Features & Create Technical Specifications

What to do:

- Prioritize features using the MoSCoW method (Must have, Should have, Could have, Won’t have)

- Create user stories for each feature (e.g., “As a passenger, I want to see real-time driver location”)

- List essential features for three apps:

- Passenger app: registration, booking, real-time tracking, payment, ratings

- Driver app: registration/verification, trip acceptance, navigation, earnings tracking

- Admin panel: user management, analytics, dispute resolution, pricing control

- Document API requirements and third-party service integrations

- Define the complete user journey and experience flow

Key decision: Will you build native apps (iOS/Android separately) or cross-platform(React Native/Flutter)? Cross-platform reduces development cost by 20-30% but may sacrifice some performance.

Step 3: Design User Experience & Wireframes

What to do:

- Create wireframes for key screens (booking, tracking, driver acceptance, payment)

- Build interactive prototypes to visualize user flows

- Design intuitive UI that works across different device sizes

- Conduct user testing with prototypes (A/B test design concepts)

- Ensure accessibility standards (WCAG 2.1 level AA minimum)

- Create design system and component library for consistency

Pro tip: Uber’s success partly relies on its minimalist design. Don’t over-complicate. Users should book a ride in 3 taps.

Step 4: Assemble Development Team & Choose Tech Stack

Your core team should include:

- 1 Project Manager – oversees timeline and deliverables

- 1-2 Backend Developers – builds APIs, databases, real-time logic

- 2-3 Mobile Developers – iOS, Android, or React Native expertise

- 1 UI/UX Designer – maintains design consistency

- 1 QA/Test Engineer – ensures quality and catches bugs

- 1 DevOps Specialist – manages infrastructure, scaling, security

| Component | Technology | Why |

|---|---|---|

| Backend | Node.js/Python/Go | Fast, scalable, handles real-time requirements |

| Database | PostgreSQL + Redis | Reliable, proven for ride-matching algorithms |

| Mobile | React Native or Flutter | 30-40% faster development than native |

| Real-Time | WebSocket/Firebase | Live driver tracking and notifications |

| Maps & GPS | Google Maps API / Mapbox | Industry standard, reliable |

| Payments | Stripe / Braintree | Secure, PCI-compliant processing |

| Push Notifications | Firebase Cloud Messaging | High delivery rate (99%+) |

| Analytics | Mixpanel / Amplitude | Track user behavior, optimize features |

| Cloud Infrastructure | AWS / Google Cloud | Scalable, reliable, auto-scaling support |

Recommended Tech Stack for 2025

Hiring decision: In-house team costs 2-3x more than outsourcing to Eastern Europe (avg. $50-75/hour) but offers more control. Hybrid approach often best: core team in-house, specialized contractors for specific features.

Looking for a team to create a ride-sharing app?

Step 5: Backend Development & API Architecture

What to build:

- Ride-matching engine – algorithm to match drivers with passengers based on location, demand, driver preferences

- Real-time tracking system – WebSocket connections for live location updates

- Payment processing – secure integration with Stripe/Braintree, PCI compliance

- User & driver databases – profile management, verification, ratings

- Admin dashboard APIs – data management, analytics, dispute handling

- Notification system – push notifications for ride updates, emergencies, messages

- Authentication & security – JWT tokens, encryption, fraud detection

Critical: Scalability considerations

- Architecture should handle 10x current user load without rebuilding

- Database queries optimized for <100ms response time

- Real-time tracking for 100K+ concurrent drivers/passengers

- Prepared for geographic expansion with multi-region support

Step 6: Frontend Development (Passenger & Driver Apps)

Passenger App Features:

- Social/email/phone signup and profile management

- Booking flow (pickup location, destination, vehicle type, fare preview)

- Real-time driver tracking with ETA

- In-app chat/calling with driver

- Multiple payment options (cards, wallets, cash, subscription)

- Trip history and receipts

- Rating and feedback system

- Emergency features (share trip, panic button)

Driver App Features:

- Registration with document verification (license, insurance, background check)

- Online/offline status management

- Trip acceptance/decline with countdown timer

- Navigation assistance with turn-by-turn directions

- Earnings tracking (daily, weekly, monthly breakdowns)

- Passenger rating system

- Scheduling and shift management

- Support chat/ticketing

Step 7: Testing, Security Audit & Optimization

What to test:

- Functional testing – all features work as expected across devices

- Load testing – app handles 100K+ concurrent users

- Security testing – penetration testing, vulnerability scanning

- Performance testing – response times, battery usage, data consumption

- Beta testing – real users in closed environment (500-1000 users)

- Payment processing – transaction success rate, security compliance

- GPS accuracy – location tracking precision, edge cases

Security checklist:

- End-to-end encryption for messages

- PCI DSS compliance for payment data

- GDPR/CCPA compliance for user data

- Secure API authentication (OAuth 2.0)

- Rate limiting to prevent abuse

- Fraud detection system (unusual patterns)

Performance targets:

- App load time: <2 seconds

- Booking confirmation: <1 second

- Driver acceptance: <500ms

- Payment processing: <3 seconds

- Battery usage: <3% per hour

- Data usage: <5MB per 30-min ride

Step 8: Launch & Scale

Pre-launch checklist:

- ✓ App Store and Google Play submissions (14+ days)

- ✓ Marketing campaign (social, press, influencers)

- ✓ Operational readiness (driver onboarding, support team)

- ✓ Analytics setup (track KPIs, user behavior)

- ✓ Legal compliance (licenses, insurance, local regulations)

- ✓ Customer support infrastructure (chat, email, phone)

Launch strategy (Phased approach):

- Soft launch – single city, limited users (500-1000)

- Monitor & optimize – track bugs, user feedback, KPIs

- Scale gradually – expand to 2-3 cities if metrics are positive

- Full market launch – nationwide or international expansion

Key metrics to track:

- Driver-to-passenger ratio (optimal: 1:3 to 1:5)

- Average wait time (target: <5 minutes)

- Cancellation rate (target: <10%)

- Daily active users

- Revenue per ride

- Customer lifetime value

- Churn rate (monthly active users who return)

| Phase | Duration | Milestones |

|---|---|---|

| Planning & Research | 2-3 weeks | Market analysis, UVP, feature list complete |

| Design | 3-4 weeks | Wireframes, prototypes, design system approved |

| Development | 8-12 weeks | Backend APIs, mobile apps, admin panel built |

| Testing & QA | 4-6 weeks | Beta testing, security audit, performance optimization |

| Launch Preparation | 2-4 weeks | App store submissions, marketing, operations setup |

| TOTAL MVP (Minimum Viable Product) | 3-6 months | Ready for soft launch in single city |

| Scale & Expansion | 3-12 months | Regional expansion, feature additions, market growth |

Realistic Development Timeline Summary

Fully-featured product (all planned features) typically requires 12-18 months from start to nationwide launch.

Creating a Ride Sharing App: 10 Core Features to Include

There are 2 ways to build a ride-sharing app:

- build two separate mobile apps for drivers and passengers (iOS or/and Android)

- create an all-in-one app.

Let’s look at the example of an all-in-one ride-sharing app and its main features.

Even if you decide to build an all-in-one ride-sharing app, it’s vital to understand that the mobile app functionality will differ depending on who is accessing it.

Registration & Profile

For passengers:

Any user journey with a ride-sharing app begins with users registering for it. So, it is advisable not to overcomplicate the registration process with unnecessary components and information. The best thing to do is to ask passengers to register with their phone number; in some cases, social media can be an excellent tool for writing your passengers.

In terms of profiles, users should upload their photos, enter their name, phone number, and payment method; view their payment history, and view ratings that they leave on drivers.

If your brand aims to give users a custom approach, then allowing users to specify their requirements for a ride (such as a nonsmoking driver, no music in a car, only female drivers, and so on) will be worth it.

Uber Registration Feature

For drivers:

To become drivers, users should be advised to submit an online tax number verification and get your rideshare company’s approval. In addition, they upload their personal information, including

- contacts

- names

- photos

- any other information that rideshare company may need

Drivers have to determine their work schedule and switch to an online mode once they start working.

For private profiles, we advise building a mobile app for Android and iOS so that drivers can track.

- their trips

- earnings

- tips

- reviews and feedback

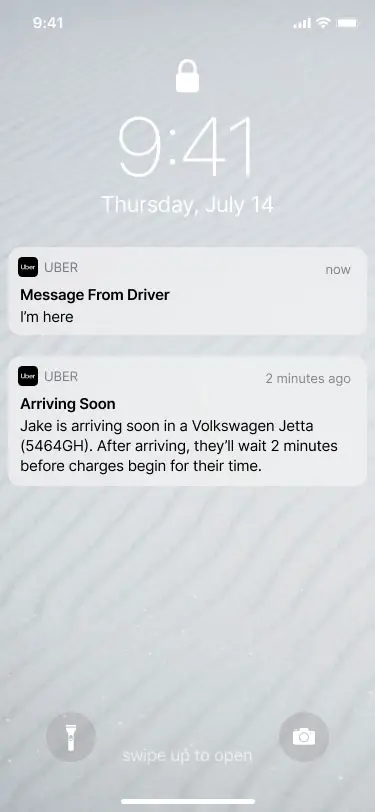

Notifications & Communication

For passengers:

Passengers tend to be impatient when waiting for a ride since it’s clear that they have to be somewhere, probably soon. Notifications save your users from constantly checking the driver’s location. We suggest sending push notifications about

- accepted ride

- canceled ride

- possible delay

- some payment issues

Communication can occur inside and outside the mobile app for Android and iOS. Usually, drivers or riders call each other to find out specific details; however, it’s also better to implement a chat system. It would be great for passengers to leave comments on a future ride and text a driver directly.

Uber Notifications Feature

For drivers:

The same rules apply to notifying drivers about possible ride opportunities, cancellations, and ride details.

Booking

For passengers:

Here’s how booking a ride should work:

Step 1: Before requesting a ride, users must enter their payment information if they haven’t indicated it in their profiles. Users should be able to save their payment details for future rides.

Step 2: For booking a ride or a seat in a car, users need to enter their current location and their destination.

Step 3: The next step is choosing a car type, a driver rate, and a preferred ride cost. These preferences depend on what factors you would like to include in the booking process.

By the way, introducing a different approach to a booking process may attract more users to your mobile application on iOS and Android. It’s vital to think of Unique Value Proposition (UVP) before building a ride-sharing app.

One thing must always stay the same: users should always see the ride cost before accepting a ride.

Uber Booking Feature

The ride price is calculated based on the pickup and dropoff locations. Lyft, for example, uses heat maps to see where the highest demand for rides is and thus charges more for rides in that area.

For drivers:

Drivers should only be able to accept or decline a ride. The time for getting a ride should be limited. For our Uber-like app for scooter rides that Sloboda Studio helped build, drivers can accept a ride in 10 seconds, or the request goes to another nearby driver.

My Rides

For passengers:

Some users use ride-sharing mobile apps quite often. So they need to see the complete history of their rides.

Instead of going to the personal profile, we suggest creating a separate “My Rides” tab, where passengers can view the number of rides they have completed and their details, such as:

- price

- driver

- destination

- payment details

Uber Your Trips Feature

For drivers:

The same logic and functionality should be applied to the driver’s side of an application.

GPS Location

GPS is used for detecting someone’s location. By using GPS in a ride-sharing mobile app, users and drivers will save time by not needing to enter their locations manually.

In addition, riders can use a feature such as real-time tracking. Real-time tracking allows riders to track a driver’s exact location. Often, a GPS can take drivers on the wrong route. So riders can always call drivers and direct them to the correct site and route.

Uber Geolocation Feature

Payments

Payments should be processed before completing the ride. This way, even if a passenger decides to cancel a ride at the last minute, your driver won’t lose the money.

If your ride-sharing app accepts cash, this should be clear before passengers book a ride.

Usually, ride-sharing mobile apps use third-party payment providers for securely processing payment transactions. As an example, Uber chose Braintree; however, there are other popular and trustworthy payment providers, such as Stripe and Paypal.

Tipping a driver is a great feature that should not be overlooked, as we all are accustomed to tipping people for the provided services. In case of a cashless payment, we advise giving passengers an option to list a driver after completing their ride inside an app. Passengers choose how much they want to tip on their own.

Reviews & Ratings

Ratings and reviews are a two-way street. We encourage you to allow both drivers and passengers to rate each other. This will give a clearer picture of the driver doing a lousy job and who should be banned. However, not all ride-sharing apps allow the review and rating of passengers.

Passenger feedback gives a fuller picture of a driver’s behavior and driving skill. Nobody would want to get into a car with a driver who swears a lot or who is extremely chatty.

Localization

If you are building an international ride-sharing app, then the ability to switch between languages is a must-have. Even if your rideshare company only operates in one country, making a multilingual ride-sharing app is advisable since there is a high probability of foreigners using your mobile app.

Nowadays, some popular mobile apps present the function of an English-speaking driver.

Our advice: don’t go overboard with languages, make an app based on:

- its location of operation

- English and any other official language that is spoken in that country

Admin Panel

Our advice is to build an admin panel as a web app. It’s just easier for a rideshare company’s staff to manage the processes from a computer. Admins usually have full access, they control both passengers and drivers

- track payment transactions

- view statistics

Pros and Cons of Building a Ride-Sharing App from Scratch

Custom development allows you to begin building a ride-sharing app the way you want and at a pace suitable for you.

Pros of Building a Ride-Sharing App from Scratch

We collected more than one fair share of pros.

Customization

By starting to create a ride-sharing app from scratch, it becomes possible to create

- customized features

- unique design

Scalability

Time-to-market can be somewhat of an issue for your product. That’s why your goal would be to launch it as fast as possible. This means that you won’t have time for expanded functionality, only the core features.

But you know what? When the time comes to broaden the app’s functionality, there won’t be any difficulties since custom ride-sharing app development allows you to be quite flexible in terms of features and product architecture.

Security

Storing drivers’ and passengers’ personal information is always a sensitive issue. With custom development, a team of developers would use encryption to protect the data.

Cons of Building a Ride-Sharing App from Scratch

Like each industry, ride-sharing has some cons. We’re ready to share the most crucial.

Cost

How much does it cost to create a ride-sharing app? Custom development indeed costs more money than some ready-made solutions, but it provides users with a completely different level of functionality and UX.

Even if you decide to use a ready-made solution at first, you would still need to scale your ride-sharing app at one point. And the fact is a ready-made solution is not always scalable. So, it would be necessary to rebuild it from scratch anyway.

Time

Three to six months – that’s our average estimate for the product’s MVP. It all depends on the app’s functionality and complexity.

How Much Does It Cost to Start a Ride Sharing App

Essential features are critical in pricing and the amount of time necessary.

There are a few factors that influence the development costs:

Development origin

The development origin depends on whether you are going to hire

- in-house development team

- outsource

Creating a team in the USA or UK would be more expensive than outsourcing ride-sharing app development to Eastern Europe.

App’s complexity

Answering how to start a rideshare business, remember to take its complexity into account. The mobile app’s complexity is based on the number of features and the technologies used.

Design requirements

Your app’s design will be making the first impression on the users, along with the app’s speed and other factors. Nevertheless, it’s your choice of how fancy you want the mobile app to look.

A word of advice: don’t concentrate too much on the app’s design. It is quite possible that in the future, you will be doing rebranding anyway. Spending a lot of time and money on design seems like a big waste during the MVP stage.

Support and maintenance

Most mobile Android and iOS apps usually need tech support after launching. There is always something to work on. The only questions are how critical it can get and how much it will cost.

Want to build an Uber-like app?

Business and Monetization Models of Ride-Sharing Apps

A business model of the sharing economy – in particular, the on-demand ride-sharing model – has made it possible to connect supply and demand easily and seamlessly.

What Uber created at the beginning of their work and further down the road has set the tone for other companies. Uber created such a model where there was a win-win situation both for

- customers

- drivers

- rideshare company itself

Let’s look into the main monetization models that Uber-like companies use.

Commission Fees

This is the number one revenue model for any kind of ride-sharing mobile app. A commission-based revenue model is a monetization model that charges a service fee from each payment transaction.

A ride-sharing app can charge either the passenger, the driver, or both. For instance, Uber charges the driver 25% and the passenger pays a sales tax per ride. Lyft charges the driver 20%. BlaBlaCar collects a service fee, including VAT, from passengers.

Advertising

Advertising is a way to profit from putting ads from third-party providers, especially in a mobile app. Many ride-sharing apps don’t use it due to fear of losing the users by bombarding them with advertising.

Partnering

Collaborating with other companies is always an excellent way to build relationships with trusted brands, get more exposure, and earn money at the same time.

That’s what Lyft did when it partnered with BMW to promote its new BMW 7 Series. Lyft offered free rides in the BMW 7 Series for its passengers in selected cities and profited from partnering with one of the biggest car manufacturers in the world.

Ride-Sharing Market Overview: 2024-2030 Analysis

The rideshare industry is experiencing explosive growth. Here’s what the latest market data tells us about the opportunity ahead.

Global Market Size & Growth Projections

Current Market Reality (2024-2025):

- Combined ride-hailing + taxi market: $270.81 billion in 2024, projected to reach $301.52 billion in 2025

- Ride-hailing segment alone: $158.65 billion in 2025, with a compound annual growth rate (CAGR) of 16.61% through 2030

- Expected market value by 2030: $342.07 billion in the ride-hailing segment alone

- Expected market value by 2033: $712.08 billion (combined taxi + ride-hailing, at 11.34% CAGR)

Long-term outlook: The global ride-hailing market is projected to grow from $145.8 billion in 2025 to $798.8 billion by 2035 at an 18.5% CAGR.

User Growth & Market Penetration

- Current active users: 380.60 million by the end of 2029 (up from ~170 million in 2020)

- User penetration rates:

- 2024: 18.6%

- 2029: 25.3% (projected)

- Average revenue per user: $28.09 (and growing with premium services)

- Monthly active users (Uber alone): 93 million in the US, with 7 billion+ rides completed annually across 70+ countries

- Revenue scale (Uber 2020): $18.13 billion gross bookings, $11+ billion net revenue

This means the market has doubled its user base in just 4 years and continues to accelerate.

Key Market Drivers in 2025 and Beyond

Understanding WHY the market is growing helps you position your app correctly:

- EV Adoption – Electric vehicles are becoming standard in ride-hailing (e.g., Xanh SM in Vietnam)

- AI & Automation – Route optimization, surge pricing algorithms, demand forecasting improving rapidly

- Regional Expansion – New markets opening faster than existing players can penetrate them

- Economic Pressure – Younger generations avoiding car ownership due to cost; preferring ride-sharing

- Sustainability Focus – Environmental concerns driving interest in shared mobility and EV options

- Subscription Models – Monthly passes and loyalty programs gaining adoption (e.g., Uber Pass, Lyft Plus)

- Safety Enhancements – Background checks, in-app emergency features, driver screening improving user trust

- Integration with Public Transit – Apps now connect with buses, trains, scooters for multi-modal journeys

Market Challenges & How to Position Your App

Every market opportunity comes with challenges. Understanding these obstacles helps you position your app to avoid the pitfalls that have derailed other startups.

Challenge 1: Market Saturation in Major Cities

The problem: In places like New York, Los Angeles, and San Francisco, Uber and Lyft have nearly complete market dominance. Customer acquisition costs are sky-high, and users have no reason to switch from their established apps.

How to overcome it: Focus on underserved geographic markets where demand is strong but existing players provide poor service. This means tier-2 and tier-3 cities, suburban areas, and regions where Uber/Lyft have limited presence. You’ll grow slower initially, but unit economics will be better and customer acquisition costs will be lower.

Challenge 2: Brutal Competition from Established Players

The problem: Uber and Lyft have unlimited resources, brand recognition, and network effects. They can drop prices, spend heavily on marketing, and acquire startups that threaten them.

How to overcome it: Don’t try to beat them at their own game. Instead, develop a clear Unique Value Proposition (UVP). This could be better pricing for budget-conscious riders, specialized services (women-only drivers, luxury cars, eco-friendly vehicles), superior UX, or better driver pay to attract higher-quality drivers.

Challenge 3: Driver Retention Issues

The problem: Drivers are the lifeblood of your platform, but they’re also flexible workers who switch between Uber, Lyft, and local competitors based on hourly rates. High churn means fewer available rides, worse user experience, and a death spiral for your platform.

How to overcome it: Build driver loyalty through competitive payouts (75-80% for drivers is better than 70-75%), transparent earnings, flexible scheduling, and meaningful incentive programs. Also, create tools that make their job easier—better navigation, less friction in the acceptance process, support for multiple vehicle types.

Challenge 4: Regulatory Complexity in Multiple Markets

The problem: Licensing requirements, insurance obligations, and local regulations vary wildly by city and country. What works in Austin might be illegal in New York. Compliance costs add up quickly and can sink a startup with limited resources.

How to overcome it: Build compliance into your architecture from day one. Budget for local legal teams in each market you enter. Start in a single market where you understand regulations deeply, then expand methodically. Don’t try to launch nationally or internationally too quickly—this is how startups burn cash on regulatory fines and forced shutdowns.

Challenge 5: Unit Economics Pressure

The problem: Many rideshare companies struggle with profitable unit economics. They take 20-30% commission, but operating costs (customer support, fraud prevention, platform maintenance) eat into margins quickly.

How to overcome it: Target markets where driver supply exceeds demand (allows lower commission rates while drivers are still available), focus on high-frequency users who ride multiple times per week, optimize for profitable routes and times of day, and use dynamic pricing intelligently to maximize revenue per ride without crushing the user experience.

Understanding who dominates the market and why will help you identify market gaps and opportunities. Here’s a detailed look at the major players that dominate the rideshare industry.

Uber – The Global Dominant Force

Uber is the 800-pound gorilla of ridesharing, and their dominance is well-deserved through relentless execution and first-mover advantage.

Market position:

- Market share: 37.2% globally

- Gross bookings (2024): $43.97 billion

- Monthly active users (US): 93 million

- Geographic reach: 70+ countries across 6 continents

- Annual rides: 7 billion+ globally

Why they dominate:

Uber’s success comes from aggressive international expansion, continuous feature innovation, and willingness to operate in regulatory gray areas when necessary. They offer the widest variety of ride types (UberX, Uber Eats, Uber Freight), have the most driver supply in major cities, and their brand is nearly synonymous with ridesharing in Western markets.

Vulnerabilities:

Despite market dominance, Uber faces challenges. Driver satisfaction (only 45% of Uber drivers report satisfaction vs 52% for Lyft), regulatory battles in multiple countries, and rising operating costs pressure profitability. In international markets, they’ve faced strong competition from regional players who understand local preferences better.

Strategic takeaway: You can’t beat Uber head-to-head in major US cities. But you can win by specializing (luxury rides, eco-friendly, women drivers) or dominating in regions where they’re weak or absent.

DiDi – The Asian Giant

DiDi is the undisputed king of Asia, with the most users and the strongest presence in the world’s most populous continent.

Market position:

- Market share: 32.4% globally

- Primary markets: China, Brazil

- Total funding raised: $21.2 billion (one of the most-funded startups ever)

- Estimated annual revenue: $22 billion+

- User base: 600+ million users

How they got here:

DiDi started in China and dominated by understanding local preferences, payment methods (mobile wallets), and regulatory requirements better than Western competitors. When Uber tried to enter China aggressively, DiDi outmaneuvered them in price competition and local partnerships. The company then acquired Uber’s China operations for $35 billion and took a 15.4% stake in Uber in return.

Current strategy:

DiDi is expanding internationally to Brazil and Southeast Asia, challenging Uber and Grab in these regions. They’re also investing heavily in autonomous vehicles and have listed on the stock exchange (though faced delisting issues). In China, they have near-monopoly control of the ridesharing market.

Strategic takeaway: DiDi proves that regional dominance is possible if you understand your market better than global competitors. They’re not trying to beat Uber in the US; they own their backyard completely.

Lyft – The Specialized American Player

Lyft is the only other major rideshare player in North America, and they’ve carved out a meaningful position through focus and specialization.

Market position:

- Market share: 31% in the United States

- Geographic reach: 644 cities in USA, 12 cities in Canada

- Monthly active users: 50+ million

- Estimated annual revenue: $3.5-4 billion (2024)

- Q1 2025 revenue: $609 million

How they compete:

Lyft’s strategy is to focus exclusively on North America and compete on driver experience and customer service rather than trying to be everything Uber is. They position themselves as the “friendlier” alternative with better driver pay and more transparent pricing. Their premium service (Lyft Plus) and rental car partnerships differentiate them from Uber.

Why they’re still relevant:

In a market where Uber dominates, Lyft survives because many users prefer their experience, and network effects work in both directions—riders want drivers, drivers want riders, and Lyft has enough critical mass in most US cities to remain viable. However, Lyft has struggled internationally and largely gave up trying to compete globally.

Strategic takeaway: You don’t need to be number one to be profitable. Lyft is #2 in the US and makes substantial revenue. Being a strong regional player with a differentiated brand and loyal customer base can be a winning strategy.

Grab – The Southeast Asian Victor

Grab dominates Southeast Asia by understanding regional needs better than any other competitor.

Market position:

- Geographic reach: 55+ cities across Southeast Asia (Singapore, Malaysia, Thailand, Vietnam, Philippines, Indonesia)

- User base: 40+ million

- Estimated annual revenue: $1-2 billion

- Business model: Transport (ridesharing), food delivery (GrabFood), payments (GrabPay)

- Recent funding: Alibaba planning $3 billion investment

Why they win in Southeast Asia:

Grab’s genius is diversification. They started with ridesharing but added food delivery and payments, becoming an essential app for Southeast Asian daily life. This creates strong network effects—users open Grab multiple times daily for rides, food, or payments, increasing ride visibility and frequency.

Strategic advantage:

Grab also works with both private car owners and licensed taxi drivers, which gives them more supply flexibility than pure rideshare-only platforms. This hybrid model helps them maintain steady supply even when demand fluctuates.

Strategic takeaway: Consider bundled services. A rideshare app that also offers food delivery or other services creates more reasons for users to open the app daily, improving unit economics.

Ola – The Indian Challenger

Ola is proof that you can compete successfully against Uber in developing markets by understanding local needs.

Market position:

- Primary market: India (80%+ of operations)

- Secondary markets: Australia, UK, New Zealand

- User base: 80+ million

- Estimated annual revenue: $500 million-$1 billion

- Valuation: Achieved unicorn status ($1 billion+)

How they’re winning:

Ola started in India and positioned itself as a local alternative to Uber, with better understanding of Indian payment methods (UPI), lower commission rates, and strong driver relationships. When Uber tried to undercut them on price and take market share, Ola had the support of Indian investors and government sympathy as a “homegrown” company.

Strategic pivot:

Recently, Ola has tried to expand internationally to Australia, UK, and New Zealand with mixed results. Their international expansion is slower than domestic growth, suggesting that deep local knowledge is harder to replicate than they hoped.

Strategic takeaway: There’s still massive opportunity in developing markets where global players haven’t established dominance. If you understand local culture, payment systems, and driver economics, you can build a billion-dollar company as a regional player.

Bolt – The European Tech-Driven Player

Bolt is an interesting case—a European player that’s competing globally by using superior technology and innovation as their differentiator.

Market position:

- Primary markets: Europe, Africa, Latin America

- Geographic reach: 50+ countries

- Estimated annual revenue: $500 million-$1 billion

- Unique offering: Fast, reliable service with strong tech foundation

- Recent expansion: Growing rapidly in South Africa, Egypt, Mexico

Their advantage:

Bolt started in Estonia (a tech hub) and built their platform with exceptional engineering quality. They emphasize speed of service, reliability, and tech innovation. Their app is known for being faster and more responsive than competitors, which matters for ride-hailing where milliseconds affect user experience.

Strategy:

Rather than trying to beat Uber and Lyft in established North American markets, Bolt is building dominance in emerging markets and Europe where competition is less established. They’re also expanding into food delivery (Bolt Food) similar to Grab’s model.

Strategic takeaway: Superior technology and engineering can be a competitive advantage in underdeveloped markets where infrastructure is weak and users will reward reliable, fast platforms.

| Company | Strength | Market | Lesson for Startups |

|---|---|---|---|

| Uber | Scale, brand, network effects, capital | Global | You can’t win on their turf in mature markets |

| DiDi | Local dominance, market understanding, capital | Asia | Regional focus + local knowledge = dominance |

| Lyft | Customer focus, differentiation | North America | Being #2 can be profitable with strong positioning |

| Grab | Service bundling, regional specialization | Southeast Asia | Multiple services = stronger network effects |

| Ola | Local understanding, driver-friendly | India/Dev Markets | Emerging markets still have room for regional winners |

| Bolt | Tech superiority, international growth | Europe/Emerging | Better tech can compete against bigger players |

Market Leaders & Their Competitive Advantages

If you’re considering launching a rideshare app, understand why 2024-2025 is actually a better time than it was 5 years ago.

✓ Market is doubling every 4-5 years – Massive demand growth still happening

✓ Technology stack is mature and affordable – Easy to build at scale now

✓ Venture capital still flowing into mobility startups – Funding still available

✓ Regional opportunities remain – Asia, Africa, Latin America still underserved

✓ Improved regulatory frameworks – Easier to navigate compliance than 2015-2020

✓ AI/ML capabilities enable differentiation – Smarter routing, better pricing, predictive analytics

✓ User expectations are set – People know how rideshare apps work (lower education costs)

✓ Outsourced development affordability – High-quality teams available at $40-75/hour from Eastern Europe

✓ White-label and open-source solutions available – Faster to launch MVP

The barrier to entry is lower than ever, but success still requires a deep understanding of your local market, better execution than competitors, and clear differentiation.

Difference Between Ride-Sharing and Taxi Services

Mobility

With ride-sharing, passengers can find a ride via a mobile app.

A ride-sharing app finds the closest available car and matches it with a passenger.

Passengers know instantly when a vehicle will arrive and, based on this information, can accept or decline the ride with a driver. They don’t have to wait for a taxi with a driver to appear on the street to hail it or call a taxi company and wait 15 minutes for the car to pick them up.

Price Variety

With taxis, passengers don’t get to choose how much they want to pay, plus they usually don’t even know how much the ride will cost them.

Ride-sharing apps allow passengers to choose what type of car with a driver they want – a budget or a luxury one. Secondly, passengers are always informed about the ride price before getting into the car.

Payment Methods

Ride-sharing mobile apps let users pay with a credit card and not worry about having enough cash for a driver. Most ride-sharing mobile apps allow users to leave tips for a driver to be paid with their credit card.

There are three main types of apps where passengers can share either a ride or a car with a driver:

- Ride-sharing apps

With ride-sharing, passengers determine the destination. Ridesharing doesn’t always have to be shared with other passengers. It can just be a great alternative to a taxi. Although, the main benefit of ride-sharing apps for passengers is that they can share fares.

Examples: Uber, Lyft, DiDi, Grab, Curb.

- Car-pooling apps

With carpooling, the driver is the one who decides on the destination; the passengers are just riding along to the same goal – often, they’re intercity trips. Carpooling can be for free or for a fixed fee.

Examples: BlaBlaCar, Carma Pooling, Waze Carpool.

- Peer-to-peer car-sharing apps

Peer-to-peer car sharing is a practice where a car owner or company rents out their vehicles for a fixed price and a specific time frame.

Both renters and car owners can take advantage of such a model. Renters don’t have to go to a specific car service to rent a car. Renters can find a nearby car, and car owners can profit when they’re not even using their car.

This type of ride-sharing is especially popular with travelers.

Examples: Getaround, Turo, Zipcar, RelayRides, Hertz.

Final Thoughts

In brief, ride-sharing has become a typical activity for those in need of a ride. “I’ll Uber it” is now a standard phrase that you hear at every party or gathering.

The global ride-sharing market is experiencing significant growth. More local ride-sharing apps appear aiming to take over the market. We created this article that has everything to know about creating a ride-sharing mobile app.

There are nine tips on how to create a ride-sharing app that we highly recommend you check out. Here are the most important steps:

- market and competitors’ research

- UVP

- revenue models

Besides, we have already built an Uber-like mobile app for one of our clients and have a lot to share about our experience. Contact us to gather some valuable insights from a primary source.

Frequently Asked Questions

What is a ride-share app?

A ride-sharing app is a mobile application that connects passengers with drivers who use their personal vehicles to provide transportation services. Through the app, passengers can request rides in real time, see driver locations, set pickup and drop-off points, and pay digitally. These apps facilitate convenient, on-demand rides often at a lower cost than traditional taxis, leveraging smartphone technology to match supply and demand efficiently. Examples include well-known services like Uber and Lyft.

What is the difference between a ride-sharing app and a taxi service?

Ride-sharing is a service that helps passengers find a one-way trip in a short time.

Unlike taxi services, drivers are the owners of transport and aren’t registered as a taxi service. This app differs from the taxi service with its:

– mobility – it is easy to detect and trace the car path

– huge variety of prices

– online payment method

What are the reasons to choose a ride-sharing app development from scratch?

Developing a ride-sharing app from scratch helps businesses take a decent position in a fairly wide transport market and bypass competitors.

Advantages of ride-sharing app development from scratch:

– Customization (it will allow you to add unique features and attract users)

– Scalability (since the architecture is not too complex)

– Security (a development team will be able to use encryption to protect data).

How much does it cost to develop a ride-sharing app?

Before starting a ride-sharing app, it’s crucial to pay attention to the price-forming factors such as:

1) Development type: hiring an in-house team or outsourcing.

2) App’s complexity

3) Design requirements

4) Support and maintenance after launching

Taking into account these factors, the most optimal cost and the quality option would be a reliable outsourcing partner from Eastern Europe, where the average programmer’s rate is $50-75/hour.